The Congressional Research Service released a report last week on the causes of the explosion of inequality in the United States. The report analyzes tax policy, wages, capital income, and other factors, then determines to what extent each has contributed to the rising Gini coefficient. Jared Bernstein has the best short breakdown of the results here and here.

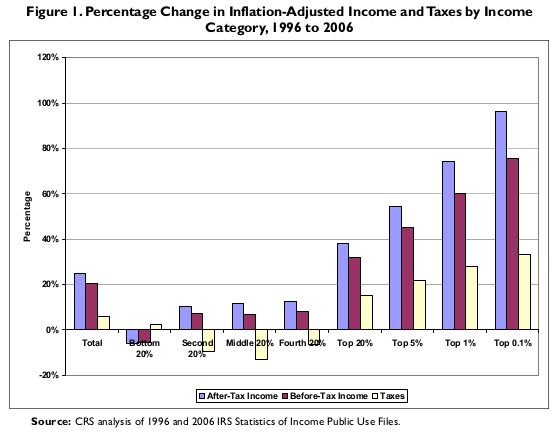

The report provided a neat graph of the percent increase in real income broken down by quintile and then more finely at the top of the income distribution:

The most troubling part of this chart is the bottom 20%. Those in the bottom quintile have been hit pretty hard: their before-tax and after-tax incomes have fallen, and the amount they pay in taxes has risen. But perhaps the most interesting thing in the report is the breakdown of the contributors to the recent inequality increase:

![]()

As you can see, capital gains are the biggest contributor to the recent rise in inequality. Retirement finishes an odd second, but only because the percent of total income flowing to retired people has increased as the number of retired people has increased, and that has had a disequalizing effect. Tax policy comes out a close third, as the tax code became much less progressive in the period measured by this study.

Excepting the retirement anomaly, what you have driving inequality is money paid out to investors and redistribution towards the rich caused by tax code changes. For a country that is at least rhetorically dedicated to an ideology of rewarding hard work, this should be appalling. The typical defenders of the excess incomes of the wealthiest in the United States like to tell Horatio Alger stories, i.e. rags to riches stories in which present millionaires get that way through hard work, innovation, and entrepreneurial ventures.

While it is true that people occasionally amass fortunes this way, the very rich generally pull down huge sums of money unrelated to any actual work. According to the CRS report, a whopping 51.9% of the income pulled down by the top 0.1% came from capital gains and dividends, while only 18.6% came from wages and salaries. Those at the very top of the income distribution are not making their money as highly-paid executives. They may bring down some income that way, but the overwhelming majority of it comes from elsewhere.

Even those who are held up as paradigmatic cases for how hard work and innovation lead to riches often make their money on capital gains. For instance, Steve Jobs made the majority of his income not from his position at Apple, but due to some well-timed investments in Pixar. He happened to also spearhead interesting products, but that is not where most of his lifetime earnings came from. Warren Buffet, sometimes the richest man in the world depending on the day, has spent his entire life generating income from capital gains.

Usually left-leaning commentators will go on about the preferred tax treatment of capital gains — they are taxed at a flat 15% rate, not as normal income — but I just want to raise a basic fairness point here. As much as I am fully aware of the necessity of investment within a capitalist economy and how investors take on some risk (although that is overblown), there is still a basic objection to be made against capital income on very American grounds.

Income collected through capital gains and dividends is income that comes from owning, not from working. For the very rich especially, all they need to do is hire someone to manage their investments, and then they can literally do nothing and live simply off the returns. Once you have enough money built up, using it to own profitable ventures can deliver more income in a year than many earn in a lifetime. Is this fair? Does this reward hard work? Does this comport with the American Dream notion of Just Deserts?

Our social understanding of what generates the greatest economic success in the US is totally divorced from reality. If people knew that there was a small class of people at the very top who brought down huge incomes that have absolutely nothing to do with them working hard, I wonder if they would change their minds about the basic fairness of inequality. Right now the rags-to-riches stories and dogma are so pervasive that I suspect only a small number of people actually understand how much the very rich “earn” without working at all.