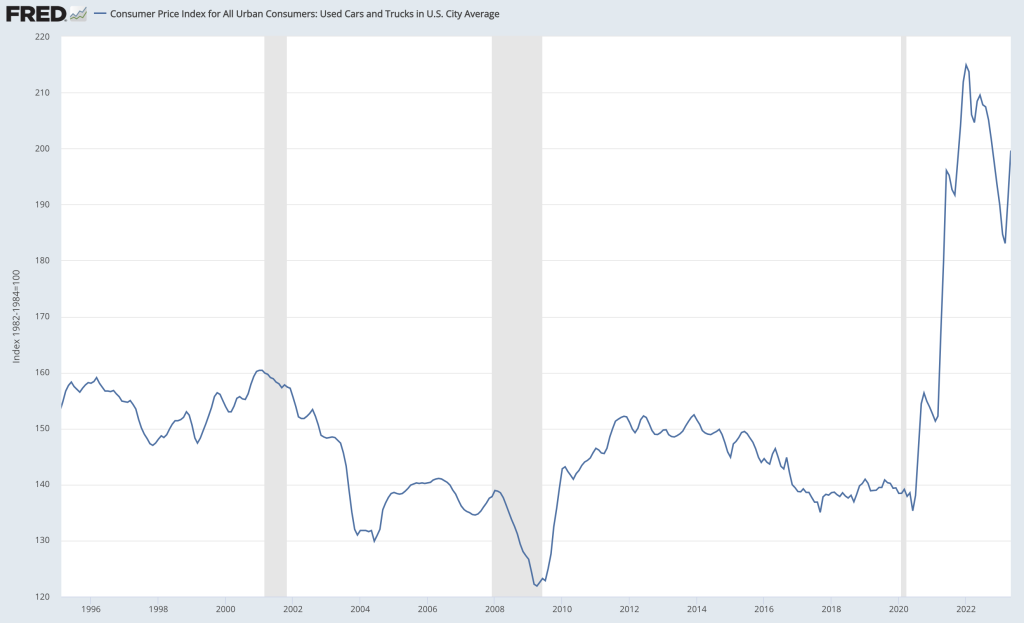

Between June 2020 and and January 2022, used car prices, which had been stable or declining for 25 years, increased by nearly 60 percent. Since then, they have come down a bit, but remain quite elevated relative to June 2020.

I remember when this spike occurred in part because there were so many stories published about why it happened and the stories contained all sorts of fascinating details about industrial supply chains. During a pandemic where there was not much to do, this kind of thing passed as entertainment.

The brief explanation is that the supply of semiconductors shrunk for a variety of reasons, including bad weather in Taiwan and COVID lockdowns in China. At the same time, demand for semiconductors increased for a variety of reasons, including people purchasing electronics for remote work and cryptocurrency mining operations.

These changing supply and demand dynamics resulted in a semiconductor “shortage,” which made it difficult for car manufacturers to get the semiconductors they need for the computers that go into modern vehicles. This then resulted in a reduction in the supply of new cars as both global and domestic car production tumbled.

With new cars in short supply, car buyers turned to the used car market. This sudden onslaught of demand for used cars outpaced the supply of used cars, which resulted in the 60 percent price jump graphed above.

Ultimately of course, this is just a story of car supply and car demand. But the richness of it was compelling and, from what I recall of the discourse at the time, nobody really disputed it. There were no heterodox writers out there saying this is all wrong and actually some other nefarious thing is afoot in the used car industry. Instead, writers inclined that way decided to emphasize the ways in which trade and competition policies were to blame for the low semiconductor supply that was driving used car inflation.

I was thinking about this example recently in the context of ongoing arguments about so-called “greedflation.” The more I’ve made efforts to understand people who argue for “greedflation,” the more I am realizing that, for them, both the substance and proof of greedflation is the way that revenue increases from inflation are distributed, i.e. how much of the additional revenue is going to profits and how much of it is going to labor.

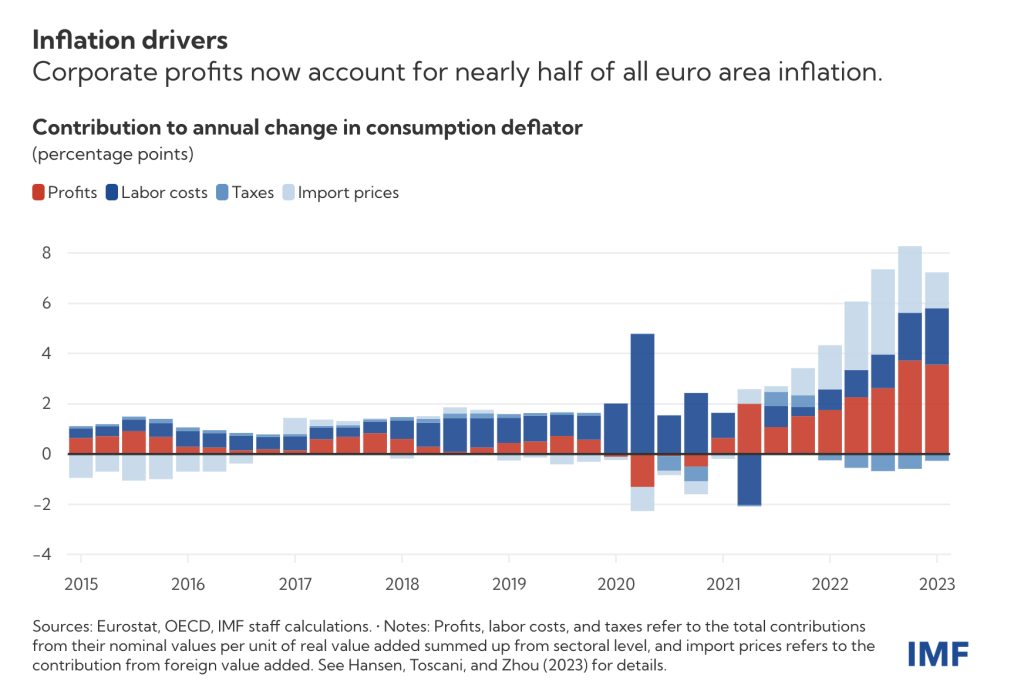

The most recent example of this has been seizing upon this chart from the IMF, which breaks this down for the Euro area in a chart that is unhelpfully titled “Inflation drivers.”

The trouble with this kind of analysis, and what I think is frustrating many people who are confronted with it, is that it works by defining the cause of inflation in a way that makes it impossible for demand or supply to ever have anything to do with it.

In the used car inflation example from above, the explanation for the price rises is that car demand outpaced car supply. From there, we get rich elaboration about what led car demand to outpace car supply, but the ultimate mechanism was basic supply-and-demand.

Yet, if we were to analyze how the additional revenue from used car inflation was distributed, what we would find is that around 100% of it flowed into the pockets of used car owners and used car dealers. Under the greedflation approach to defining these things, the 60 percent rise in used car prices was not about supply and demand in the car market or semiconductor market. It was about the profiteering of used car owners and used car dealers. They were not merely passing on input prices as there are no real input prices when we are talking about used goods being sold on the secondary market. There is only profit, only greed.

The basic demand-pull theory for these kinds of things is that, due to demand increases, supply decreases, or some combination of the two, the market-clearing price goes up. This higher price results in higher revenue. This higher revenue goes to someone, but who it goes to is not who caused the inflation. Indeed, the same inflation could result in very different revenue distributions depending on the wage-setting institutions in the economy and who owns the economy’s enterprises.

For most greedflation advocates, the cause of inflation just is whoever received the revenue from a price increase. So defined, inflation is never caused by supply or demand. It is only caused by labor or capital.

What’s so confusing and frustrating about this is that, supply-and-demand and greedflation are posited as competing theories of inflation, but in reality, they just aren’t even talking about the same thing. It is true both that the market-clearing price for used cars went up because car demand outpaced car supply and true that the revenue gains from that price hike flowed entirely as profits to used car owners and dealers. The latter does not refute the former. It’s just a topically-related fact.