Rudolf Meidner was the Swedish economist most responsible for Sweden’s economic model in the 1950s to 1970s. Near the end of his reign and the golden era of Swedish social democracy, he put forward a proposal that became known as the Meidner Plan. If followed, the Meidner Plan would have gradually transferred ownership of Swedish companies to workers by requiring the companies to issue shares to union-controlled wage-earner funds. Below is a simplified rundown of how it would have worked within the Rehn-Meidner model that the Swedish economy was already designed around.

Suppose that we start with a capitalist economy that has a specific wage differential. The wage differential refers to the difference in the hourly wage paid to different kinds of workers. In graphical terms, we can think of it like this, where the top of the bar is the highest wage received and the bottom of the bar the lowest wage received:

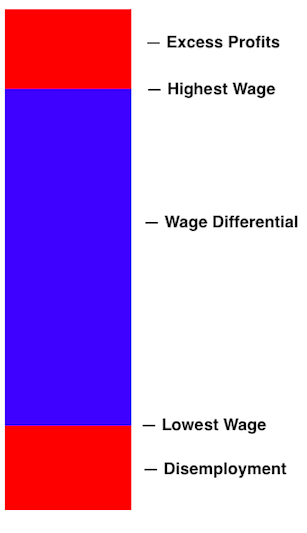

From this economy, we forcibly shrink the wage differential through a solidaristic wage policy. One way to do this is by using collective bargaining agreements to lift up the lowest wages and to bring down the highest wages. When you shrink the wage differential in this manner, the result is this (explained below):

Disemployment on the Bottom

Lifting the lowest wages causes low-productivity firms that rely heavily on low-wage labor to fail and shed workers, i.e. it causes disemployment. In US discussions, this is seen as a really terrible thing. Not so for Meidner. Because the Swedish economy so often ran at full employment, it had trouble fighting inflation. The constant disemployment caused by gradually shrinking the wage differential would actually help alleviate inflationary pressures. It would seem cruel of course to fight inflation by brutalizing low-wage workers, but disemployment was not a very brutalizing experience within the Swedish welfare state. Laid off workers would receive very generous unemployment benefits and have access to Sweden’s active labor market policies (training, education, job search assistance, in-work subsidies) to find a new job in a surviving (higher-productivity) firm.

Excess Profits on the Top

Wage restraint for the highest wages would cause high-productivity firms that rely heavily on high-wage labor to generate excess profits. This sounds like a problem, especially for socialists, but it is actually a huge opportunity. If you can capture the excess profits generated by wage restraint, you can use the resulting revenue to socialize ownership of the capital. And that’s what Meidner Plan aimed to do. Under the plan, firms would be required to issue new shares equal in value to a percentage of their profits each year. Those shares would then go into the wage-earner funds. Eventually, the shares held by the wage-earner funds would be equal to more than 50% of the outstanding shares of a company, at which point the wage-earner funds would have a controlling stake.

The mandatory share issuances function like a corporate income tax except that they do not drain anything from corporate cash flows. Instead, they simply dilute out the existing shareholders. There is some concern that announcing a plan to slowly dilute out existing shareholders would harm capital investment going forward because it would reduce the effective return on such investment. But recall that the wage restraint actually causes many firms to generate excess profits. So the drag on share value caused by the mandatory share issuances would be significantly counteracted by the boost in share value caused by the excess profits.

So, in total, the Meidner Plan would utilize solidaristic wage policy to shrink the wage differential. This would intentionally cause some disemployment at the bottom, which would help tamp down on inflation and would be met with generous unemployment benefits and assistance in being placed in new jobs in higher-productivity firms. This would also intentionally cause excess profits at the top, which would be captured through mandatory share issuances to wage-earner funds that would gradually socialize ownership of Swedish companies.