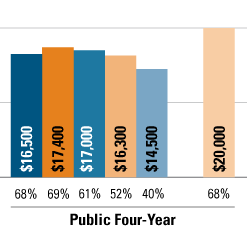

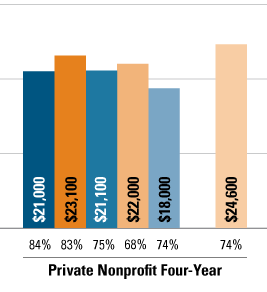

The College Board has figures for the median debt levels of people graduating college broken down by their family’s income. The full graphic with spreadsheet is at the College Board site, but here are two of them:

The bars on the left are for graduating students with family incomes of less than $30k. Moving right, the bars proceed up the income ladder: $30k-$60k, $60k-$90k, $90k-$120k, and over $120k. The bars on the far right are for independent students. They are separated out because their financial statements are not comparable to dependent students whose family incomes reflect the finances of their parents. The percentages at the bottom of each bar are what percent of students graduated with debt.

There is variation from group to group, especially in public schools where far lower percentages of the richer students graduate with debt. But of those who graduate with student debt, their debt totals are remarkably similar. The public four-years range from $14.5k to $17.4k, a $2.9k gap (which is 16.7% of the larger figure). The private four-years range from $18k to $23.1k, a $5.1k gap (which is 22.1% of the larger figure). These aren’t super-small gaps, but given that we are talking about income groups where the minimum income of richest is 4x the maximum income of the poorest, they are much smaller than you’d probably expect.

Moreover, it isn’t the poorest group that is graduating with the highest debt. In the public four-years, the poorest have the 3rd highest median debts, and is only $200 above the fourth highest median debt. In private four-years, the poorest have lower median debts than every income group except the richest.

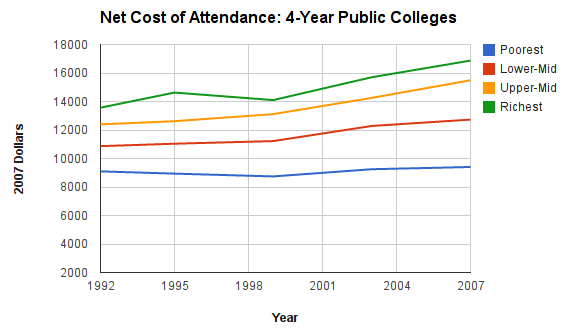

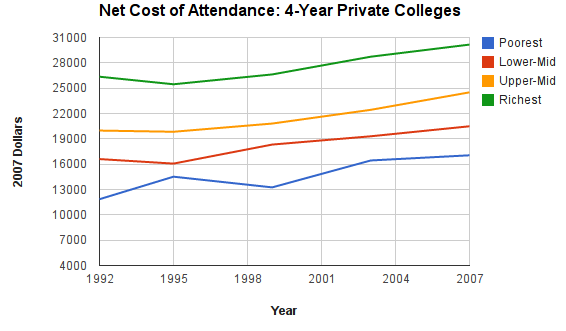

Some of this difference is probably due to the fact that lower income students go to lower-cost schools, even within these subsets. But a considerable part of it is also that colleges use price discrimination, i.e. charge kids according to their income background. Combined, these two factors have made it such that the poorest quartile of students pay just 55-57 percent of what the richest quartile pay, with those in the middle paying increasing amounts.

This price stratification has apparently done a pretty good job of eliminating out the financial advantage of rich kids. If the rich are leaving with similar levels of debt as those with dramatically less financial resources, colleges must be squeezing way more money out of them. All together, these numbers make the price discrimination system seem far more rational and coherent than I’d imagined.