Mike Konczal is out with a post today about the macroeconomic effects of student debt, a post he briefly foreshadowed in our comment blood bath a couple of days ago about an unrelated matter.

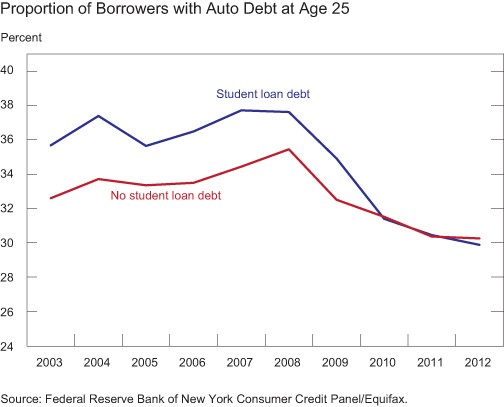

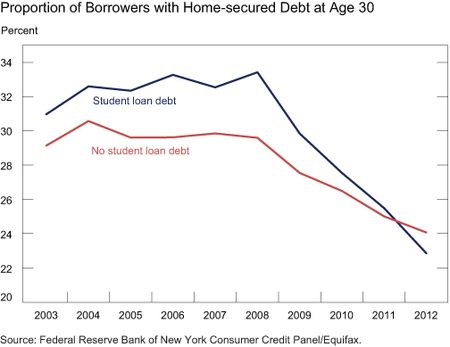

In the post, Konczal relies on a recent New York Fed report about the borrowing habits (specifically around car loans and mortgages) of those with student debt. Here are the relevant graphs:

What you are supposed to be looking at in this graph is not so much that the lines are falling. Both lines are falling and it is probably a primarily cyclical downturn (or even partly secular insofar as young people’s interests in buying cars and houses may have changed). You are supposed to be looking at the spread between those with student debt and those without student debt. In the auto loan graph, the line for those with student debt generally runs 3 percentage points higher than those without it. But now there is no gap, meaning a 3 percentage point swing. In the mortgage graph, the spread gets as high as 4 percentage points in 2008, and is now at -1 percentage point, meaning a 5 percentage point swing.

Konczal is very careful in trying to tease out what macroeconomic consequences we might try to draw from this. The last thing he wants to do, I’d guess, is become a Robert Applebaum figure who says off-the-wall silly things about this subject.

The first thing to say here is, as Konczal himself notes, that this data is not terribly helpful especially given that its only significant trend is happening during a recession. It could be the case that those with student debt are simply more responsive to cyclical downturns than those without it. To figure out whether that is the case, we need more data across more cyclical downturns, something we apparently do not have. If it is just the case that student debtors are more responsive to cyclical downturns, we wouldn’t call that a long-term macroeconomic effect.

Second, this data does not distinguish between those who graduate college with student debt and those who graduate college without it. Instead, it lumps those with student debt in one group and those without it in another. A better way to do this would be to compare college graduates with student debt against college graduates without student debt, or at least some similar kind of controls. Without that, it does not seem like these numbers actually isolate the effects of student debt, which will frustrate meaningful interpretation and policy responses.

With that said, let’s suppose for a second that the basic story Konczal is trying to lean towards is correct. Let’s suppose that those who have student debt are not taking out as many car loans or home loans (which also presumably means they are not buying as many cars or homes). Is that actually a problem?

Let’s break that analysis into two economic situations, the first one being where the economy is operating at capacity, and the second on being where the economy is under capacity.

If the economy is operating at capacity, then it does not seem to matter that student debtors are not buying homes and cars. After all, the economy is operating at capacity: what else do you want? It might change the composition of how our labor and material resources are being employed. Instead of building houses and cars, those resources will be put to use elsewhere. That’s significant macroeconomically, but not in any way that policymakers should seemingly care about.

If the economy is operating below capacity, then it only matters if the student debtors not buying houses and cars is the cause. This gets to be tricky because talking about what’s causing the economy to be below capacity is really slippery if you think inadequate aggregate demand is the cause. After all, if you need to pump up aggregate demand, you can do that in any number of ways that does not include getting student debtors to swap out their student debt for a mortgage and car note. This means, at minimum, that student debt is not a “but-for” cause of the troubles. Now maybe eradicating student debt is a particularly great way to go about it (I’m skeptical), but as there are other ways to go about it, it’s hard to really think of student debt as the specific problem anymore than the problem being “lots of people do not have more money to spend or are not in a financial position to borrow more.”