The hysteria that generally surrounds the federal debt is almost entirely a joke. Smart Republicans pretend to be concerned with it, but only insofar as they think they can use it to push what they always push: more for the rich, less for the rest. Dumb Republicans push it because they are dumb. The reporting class in DC and elsewhere push it because they don’t really understand fiscal policy, and this issue has managed to become the issue of Serious People or whatever.

Anyways, have you ever wandered who actually holds this debt? That’s a sad thing to admit to, but if you have, you are in luck because I will break it down for you here. All the data you need to figure this out is publicly available from the Flow of Funds Accounts from the Federal Reserve (table L.209) and the Monthly Statement of the Public Debt. I use the 2012 fourth quarter numbers from the Flow of Funds Accounts and the December 2012 numbers from the Monthly Statement of the Public Debt. I selected these because they are the latest available data in which the two sources line up.

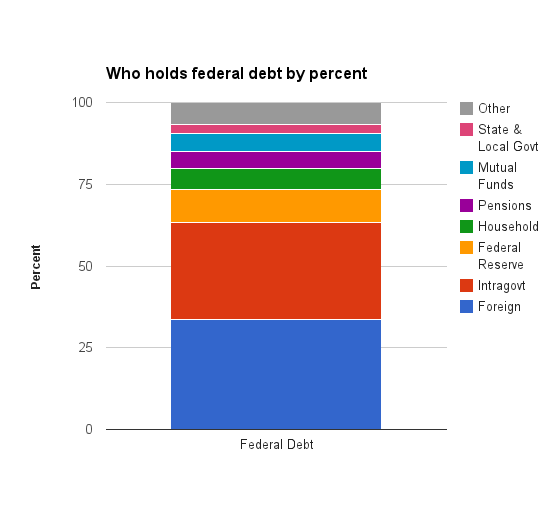

At the end of December of last year, the Treasury had a bit more than $16.4 trillion dollars of outstanding debt. Around $4.9 trillion (29.7%) of the debt is intragovernmental debt, which is debt that other government agencies hold. The biggest agency holding treasury debt is the Social Security Trust Fund. Around $1.6 trillion (10.1%) of the debt is held by the Federal Reserve, the country’s central bank. This is not that serious of a liability as the interest paid on that debt goes right back into the Treasury. The Fed holds the debt because it is a useful tool for monetary policy. So right off the bat, around 40% of the federal debt is money the government owes to itself or to the country’s central bank.

From there, the next biggest chunk is held by foreigners. Collectively, foreigners hold $5.5 trillion (33.7%) of the federal debt. The Flow of Funds account does not break that down any finer, but I believe there are other resources that do. So intragovernmental debt, debt held by the Federal Reserve, and foreign-held debt brings us to around 74% of the debt total.

The remaining 26% is held by all sorts of public and private domestic entities. About $1 trillion (6.3%) is held directly by households. Around $883 billion (5.4%) is held by private, federal, state, and local pension funds. Another $875 billion (5.3%) is held by mutual funds of one sort or another, mutual funds being a popular investment vehicle for households. State and local governments hold nearly $477 billion (2.9%). From there, a smattering of different entities hold increasingly smaller percentages of the federal debt.

When you put it all together, you wind up with something like this: