The Federal Reserve released another report on household debt in the past week or so. The report’s detailing of student debt trends has received considerable attention, including from the New York Times. Since our society loves to tell this hilarious story about our institutions of higher education being factories of egalitarianism and social mobility, this subject receives unbelievable levels of attention, usually of the alarmist sort. Here, I bring a non-alarmist perspective to the discussion.

To talk about student debt, you have to first look at the youngs, this being the story everyone wants to tell about student debt. Even though many young people are not in college and a very substantial chunk of college students are not youngs (2002 count says 39 percent of students are over the age of 25), the plight of the college student is somehow the representative plight of young people in general. Well, those youngs are not doing so badly in the report. More than 55 percent of people below the age of 25 have student debt balances of $0, and individuals below the age of 30 carry just 33 percent of all the student debt in the country.

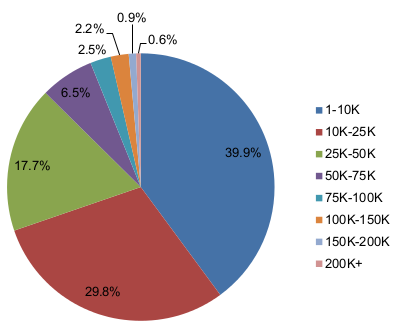

After looking at the youngs, we should direct our focus towards the distribution of student debt. Unfortunately the report does not break down debt by economic percentile. We know from prior studies that student debt disproportionately afflicts the rich. However, the report does provide a new breakdown of what the typical debt burden actually looks like:

As you can see, around 70 percent of all student debtors owe less than $25k. And this total, by the way, includes all student debtors, not just undergrads. So thrown into this mix are those with graduate degrees, as well as business, law, and medical degrees. If you were to remove those individuals out of the mix — since generally people have in mind undergraduates when talking about this stuff — that 70 percent number would jump even higher. While the super-majority of student debtors hold less than $25k in debt, the latest college wage premium numbers indicate that they are poised to make — at the median — an extra $1.05 million over the course of their lifetimes for having gotten a bachelor’s degree. For those keeping track at home, $25k is 2.4 percent of $1.05 million. Which is to say: $25k is less than one year of the college wage premium.

The rest of the report just compares student debt to other debt and talks about delinquency rates. The former is helpful just as comparisons usually are, but it is hard to imagine what sort of conclusions one is supposed to draw from them. The latter is significant, although less so than people generally imagine. If I have time and there is interest, I may write a post soon about the ways in which student debt delinquencies (or even large-scale “defaults”) should not be that big a deal for the economy. As part of the bubble bubble (the bubble we are now experiencing in the usage of the word “bubble”), we have seen all sorts of bizarre comparisons of the student debt situation to the housing bubble, generally drawing upon this delinquency data. The comparisons are almost always very confused.