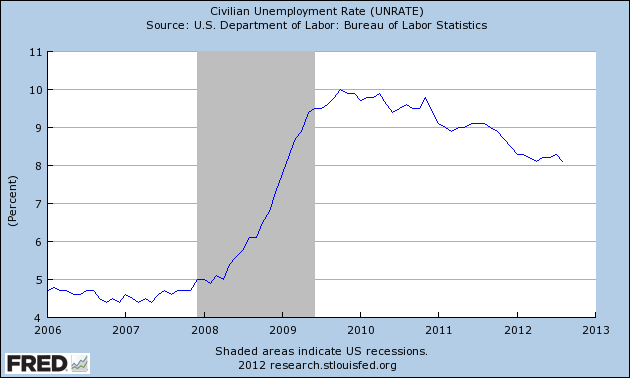

With the official unemployment rate still at 8% and current rates of job additions indicating that we will remain well below full employment for some time, it is easy to get despondent.

You look at the above graph and you see just 6 years ago we had less than 5% unemployment. What happened? It wasn’t a natural disaster. It wasn’t a big technology shock that dramatically and with great rapidity changed the structure of the labor market. No, we had a completely finance-driven collapse. Housing was marked down in value, and now, for some reason, millions of people cannot get work anymore. When put in those terms it’s absurd. Nominal shocks like the one that hit in 2008 should be totally manageable with monetary and fiscal stimulus.

But instead we got totally inadequate fiscal stimulus, and a federal reserve that was, I guess, too afraid of inflation to do little more than drive interest rates to zero. With the recent announcement of a new batch of quantitative easing and the about face of Minneapolis Fed President Narayana Kocherlakota, perhaps this totally unnecessary bout of suffering will actually begin to subside. Although, it seems too little and is certainly much too late.

To watch a completely finance-driven recession put so many people out of work and to see policymakers just let them remain there is extremely disheartening. But of course, we have been here before during the Great Depression, and the wisdom of that time is still wisdom today. In his essay “The Great Slump of 1930,” Keynes wrote about the more productive time immediately preceding the Great Depression:

The other was not a dream. This is a nightmare, which will pass away with the morning. For the resources of nature and men’s devices are just as fertile and productive as they were. The rate of our progress towards solving the material problems of life is not less rapid. We are as capable as before of affording for everyone a high standard of life—high, I mean, compared with, say, twenty years ago—and will soon learn to afford a standard higher still. We were not previously deceived. But to-day we have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time—perhaps for a long time

I guess there is some consolation that 82 years on we have managed to avoid an economic plunge as bad as the Great Depression. But of course we could do better. If in 2006 we had less than 5% unemployment, there is no reason why, under the present circumstances, we cannot have that now. As Keynes observed, we are as capable as before, but here we are in a colossal muddle.