I wrote earlier about the myth of Social Security insolvency back when scaremongering about Social Security was in the news. These days, it looks like Medicare is the new punching bag. It is hard to tell if the right-wing gave up on the Social Security stuff because of how ridiculous it was, or if they are waiting to go at it once more in the future. In either case, the story is still the same: some minor tweaks to Social Security will keep the program solvent into the infinite horizon.

I was going to go through the newest Trustees report to update the numbers from the post linked above, but luckily Evan Soltas has already done it. Under current projections, if the Social Security program is not reformed at all, it can pay out current benefits until 2033, the year that its massive trust fund will run out. After 2033, the program would have to undergo a one time 25% benefit cut in order to remain solvent. It is important to emphasize that when the trust fund runs out, that does not mean Social Security is bankrupt. It just means it has exhausted all of its amassed savings, and must run only on the revenues it brings in from taxes.

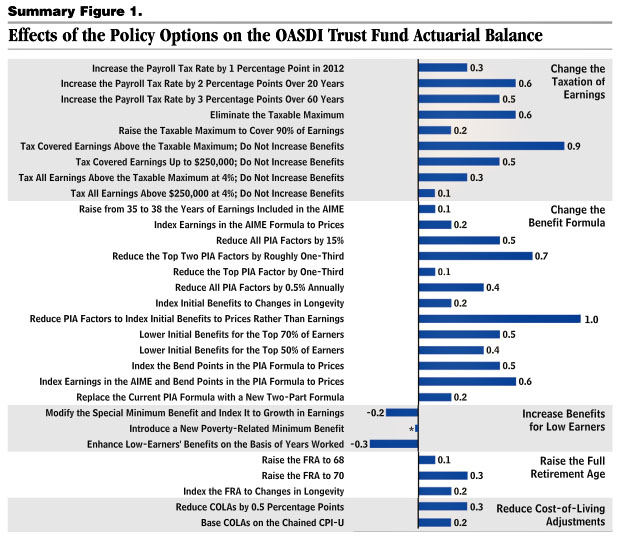

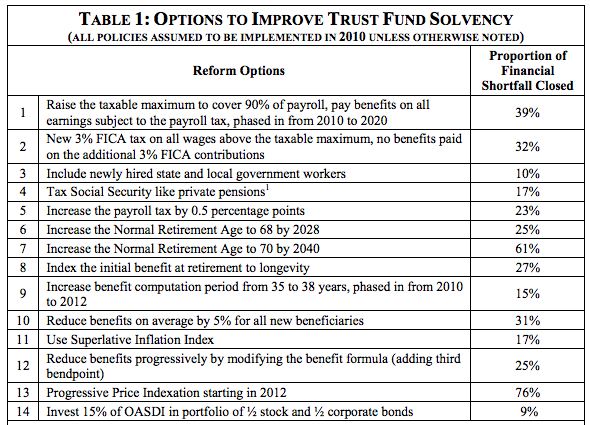

Since we want to prevent this 25% benefit cut, we need to make some changes. What changes do we need to make? Have your pick from any number of policy options courtesy of the AARP and CBO:

For the first chart from AARP, your selections need to add up to 100%. For the second chart from CBO, your selections need to add up to 0.6. My favorite option is to “Eliminate the Taxable Minimum,” an option provided in the CBO chart but not the AARP chart. Right now, individuals only pay payroll taxes for the first $100k or so (changes each year) of their income. All income over that amount escapes taxation. Eliminating the taxable minimum would subject all income to Social Security taxes, instead of exempting large chunks of income pulled down by the very rich.

You can eliminate the taxable minimum while increasing benefits in accordance with existing benefit formulas and make Social Security solvent into the 2080s. Or you can do so without increasing benefits and Social Security will run surpluses into the infinite horizon. But again, there are literally hundreds and hundreds of policy cocktails capable of solidifying Social Security’s solvency. Take a look at the charts and figure out which one you like the most.