The Federal Reserve released a new Survey of Consumer Finances that details consumer financial changes from 2007 to 2010. The big story of the report is the extremely painful impact of the Great Recession. From 2007 to 2010, real median family income fell 7.7 percent, and real mean family income fell 11.1 percent. During the same period, median net worth fell 38.8 percent and mean net worth fell 14.7 percent. Buried in the report is also new student debt data.

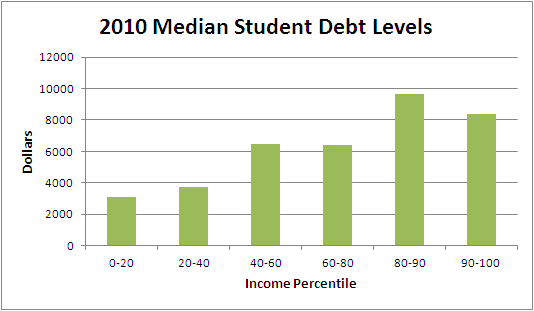

Above are the median student debt levels for families that carry any amount of installment debt, broken up by income percentile. To get these numbers, I multiplied the median installment debt levels by the percentage of installment debt made up by education loans. As you can see, student debt levels correspond pretty closely to income: those with higher student debt have higher incomes. This confirms data I have posted before and my basic point about student debt issues not really being poor people issues.

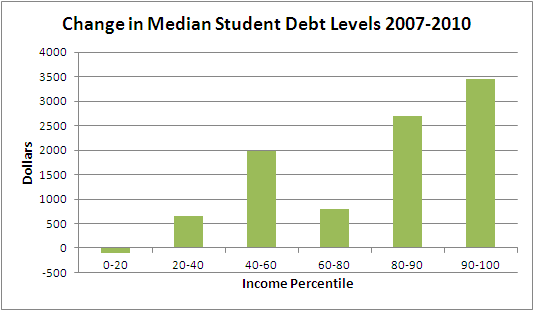

With the Fed’s 2007 survey data, we can figure out the change in debt levels as well:

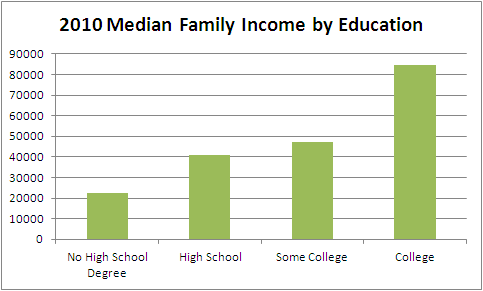

For the bottom 20 percent of income earners, debt levels have fallen slightly. Above that, debt levels have risen roughly in concert with income levels: those making higher incomes have seen bigger increases in their student debt levels. Once again, it seems clear to me that casting student debt issues as economic justice issues really misses the mark. Those with the highest debt levels tend to have the highest incomes, and getting a college degree delivers a very substantial wage premium. Here is the Fed’s breakdown of median family income by educational attainment in 2010:

I think the student debt hysteria is a fantastic moment for us to consider different college financing schemes, and I hope it keeps that discussion going. Across-the-board student debt forgiveness, however, would be a major giveaway to the rich.