The economy remains in a rut. Although economic growth has returned, it has not been the kind of rapid catch-up growth necessary to bring the country back to full employment.

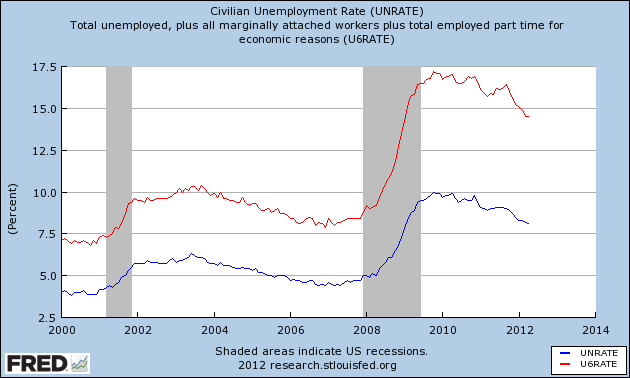

The blue line is the official unemployment rate, and the red line is the U6 rate, a measurement which includes the underemployed and those who have become so discouraged that they have stopped looking for work. Whichever measurement you prefer, the picture is not pretty. Given the anguish and sheer waste caused by unemployment, we ought to be doing everything we can to bring the country back to full employment.

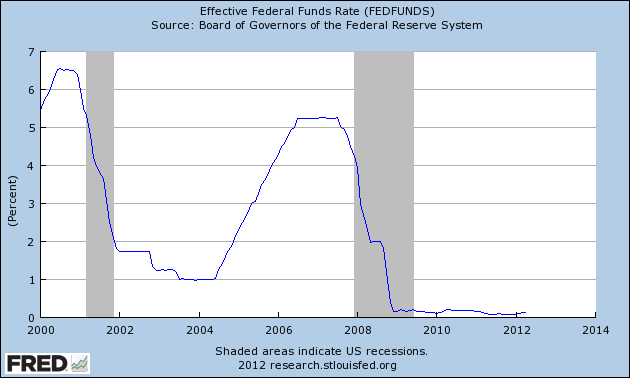

With fiscal stimulus clearly off the table due to political dysfunction, the only thing left is monetary stimulus (Federal Reserve policy). When the Federal Reserve wants to stimulate the economy, it generally does so by lowering interest rates, something it accomplishes indirectly via open market operations. However, there is a problem with that policy remedy right now: the Federal Reserve has already driven interest rates to zero and labor markets still will not clear.

This is what economists are referring to when they talk about the zero lower bound. The Federal Reserve cannot drive nominal interest rates lower than 0% because, with some exceptions, individuals are not willing to loan money out for a negative return. If all they can get is a negative return, then they would be better off holding on to the cash, and so they will. Against the zero lower bound, what can the Federal Reserve actually do to try to make things better? There are a variety of things, but here I will explain three that have been tried or frequently suggested, with greater focus on the third and most interesting policy idea.

First, the Fed can buy up assets in order to change expectations as well as future investment yields, hopefully nudging the economy towards more employment. The most talked about approach in that set of options is quantitative easing. When the Fed embarks upon quantitative easing, it creates new money, and then uses it to buy up existing financial assets, thus injecting more money into the economy. The Fed has already done quite a bit of quantitative easing, and more such easing might be on the horizon.

Second, the Fed can tolerate higher levels of inflation. When inflation rises, the real interest rate actually falls. So even though interest rates are at 0%, if the inflation rate was 5%, the real interest rate would be -5%. If the Fed could raise inflation expectations, that would encourage savers to not sit on their money, lest it be slowly sapped away from them via inflation. As of yet, for some reason, the Fed has not announced a higher inflation target, much to the outrage of notable liberal economists.

Finally, perhaps in some future world, we really could drive nominal interest rates below zero. The zero lower bound is much more a conceptual and technical barrier than it is a real thing. In fact, the zero bound is not even a zero bound, unless you describe what you are talking about in terms of interest rates. If we talked about total payback rates instead of interest rates, the zero bound would actually be the 100% bound. At the 100% payback bound, people pay back exactly what they borrow. But clearly we could bump that down to say 95% (or -5% in interest rate terms). The only real zero bound is the 0% payback bound. That is the point at which money is literally just being given away.

The main difficulty with bringing payback rates below 100% (i.e. interest rates below 0%) is getting lenders to actually loan money below that rate. Why would a lender ever loan out $100 to get less than $100 back when they can just hold on to the $100 instead? They probably would not, but as Matt Yglesias cleverly argues, in a future cashless world, we could eliminate the option they have to hold on to the $100. In dire economic recessions where the market clearing interest rate is less than 0%, the Fed could announce that it will start sapping money out of deposit accounts at a specific rate. Deposit account holders would then have an incentive to either spend the money to buy goods or to loan it out at sub-zero interest rates (it is better to loan out $100 and get $97 back than it is to hold on to $100 and have $5 of it sapped out of the account by the Fed). The only present technical barrier to this plan is the existence of physical cash, which cannot be sapped out of electronic accounts.

As fascinating as I find this plan, I must admit — as Philip Pilkington points out — that this policy idea is a bit unnerving even if is seems technically sound. The odds that people would be willing to have the Federal Reserve take money out of their accounts in order to manipulate them to lend or spend seem pretty low. Even though this is more or less what Federal Reserve interest rate policy already does, it does so in a way that is much more opaque. People will clearly notice money flowing out of their savings accounts, and most wont like it. With that limitation noted, it still stands as a theoretical possibility, and an interesting one to say the least.