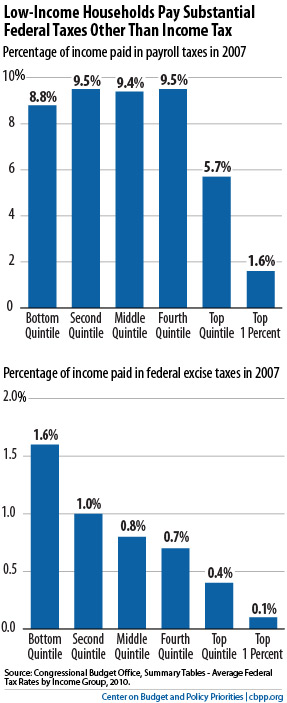

The Center for Budget and Policy Priorities put out a nice series of charts today detailing the distributional impact of various regressive taxes in the United States. One of the findings is that the lowest quintile of households pay 1.6% of their income in excise taxes each year while the top 1% pay only 0.1% of their income in excise taxes. If I were as dishonest as conservative analysts are, I would blast outrage every day about how the poor pay 16x higher tax rates than the rich. That would be the equivalent of what conservatives do when they complain about income tax distribution without mentioning any other taxes.

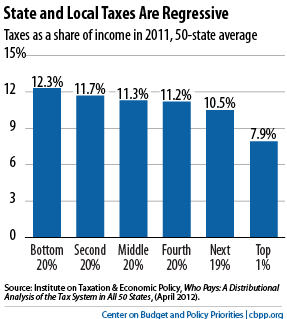

The more honest takeaway from all of this, as I have said quite often, is that some taxes are regressive and others are progressive. Focusing on any one tax without putting it in the context of the entire tax scheme is dishonest. Even flat tax advocates must concede that we need the income tax to be progressive if for no other reason than to offset the regressivity of excise taxes, payroll taxes, state taxes, and local taxes. Just how regressive are these taxes that conservative analysts conveniently ignore? The CBPP provides the following charts: