The Center for Tax Justice released a report yesterday detailing the 2011 tax burdens of different income groups in the United States. Contrary to common wisdom, the poor are not free-riding on taxes and the rich are not drowning in them. As the CTJ notes (and as I have noted before), certain taxes are progressive while others are regressive. Right wingers make a big deal out of the fact that wealthier individuals pay higher income tax rates than poorer individuals, but rarely does anyone bother to point out that poorer individuals pay higher tax rates on payroll taxes, excise taxes, and state and local taxes. The income tax has to be progressive to counteract the regressive nature of these other taxes.

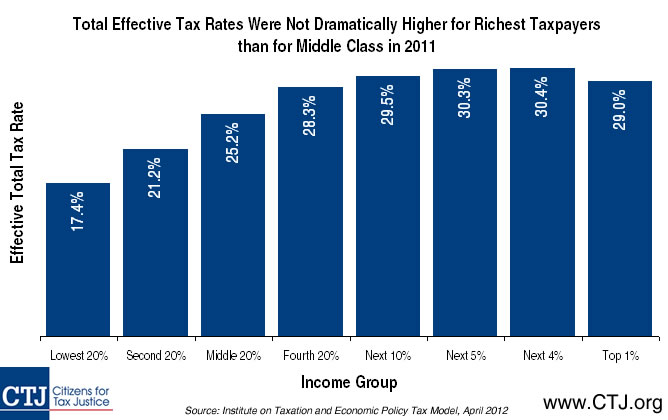

When you put all taxes together and divide by income, you wind up with the following distribution of effective tax rates:

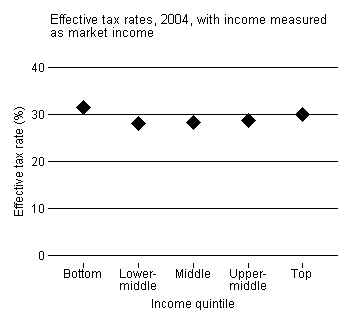

The rich aren’t exactly being soaked and the poor aren’t exactly paying nothing. Even this chart is somewhat misleading however. Certain cash transfer programs — like the Earned Income Tax Credit and Child Tax Credit — show up in this data as reductions in tax burdens. But that is a somewhat confused way to understanding those programs. Although those transfer programs are carried out through the tax code, they are actually government spending programs (sometimes called tax expenditures). Although CTJ does not include a statistical breakdown of tax burdens with cash transfers removed, I have provided such breakdowns in the past:

I do not know if that breakdown reflects the current tax distribution, but it probably closely tracks it. Cash transfers disproportionately flow to poorer people and make up much higher percentages of their incomes. So when we remove cash transfers from the tax breakdown, the effective tax rates of those with lower incomes necessarily rise. Whatever the specific breakdown winds up being, the takeaway is that the total U.S. tax system is not that progressive and the super-rich are not being taxed at oppressive rates. There is plenty of room to increase taxes on the wealthiest Americans, and poor people are not “lucky duckies” as they are sometimes grotesquely called.