Within political journalism and perhaps the public at large, analysis often proceeds on the assumption that political events have the capacity to swing public opinion. So when things like the death of Osama Bin Laden, the debt-ceiling deal, or the housing crisis happen, reporters contemplate how the public’s reaction will affect voter sentiment. But this way of understanding the effect of political events is misguided as the fallout from the housing crisis shows quite clearly.

From 2005 to 2008, an enormous number of sub-prime mortgages were issued, and highly-rated financial instruments built on top of those mortgages proliferated. This process caused an enormous, albeit artificial, spike in housing prices. When prices eventually readjusted, millions of homeowners were underwater, and the financial instruments built on top of the mortgage debt became worthless. This created a dangerous financial meltdown that government bailouts successfully prevented. The bursting bubble also caused trillions of dollars of imagined housing wealth to disappear, the fallout from which continues to drag down the economy.

Who is responsible for all of this? The almost unanimous consensus among economists and policy analysts is the one Mark Zandi provided earlier this week:

The biggest culprits in the housing fiasco came from the private sector, and more specifically from a mortgage industry that was out of control. These included lenders who originated home loans, investment bankers who packaged them into securities, rating agencies that misjudged these securities, and global investors who bought them without much, if any, study.

Despite this near consensus, two agenda-driven hacks from the right-wing American Enterprise Institute — Peter Wallison and Edward Pinto — have been floating out an alternative analysis that blames the government-secured enterprises Fannie Mae and Freddie Mac. Their counter-theory has been panned and dismissed by so many experts in so many places that I could fill an entire blog post just linking to them. The Mark Zandi piece linked above critiques their position, and Edward Nocera detailed some of the problems with what he calls The Big Lie in the New York Times a short time ago.

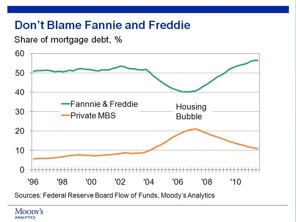

Mark Zandi also provides one of the clearest graphs so far debunking this idea. The graph shows that Fannie and Freddie’s market share dramatically declined as the private sector massively expanded its sub-prime lending:

Under a style of political analysis that assumes political events can really swing sentiment to one side or another, one would predict that this political event swung sentiment to the left. After all, it was bankers and reckless financial capitalism that caused millions of people to lose their homes, their jobs, and their savings. Although there may have been some individuals who swung in that direction, the swing does not appear to be that pronounced.

That is because people do not respond to political events; they respond to what trusted sources tell them about political events. This seems especially true when dealing with somewhat complicated subjects like the housing bubble. Conservatives who listen to conservative media heard the frankly absurd story that the government was to blame, that Fannie and Freddie was to blame, and that too much regulation was to blame. These assertions were bolstered within conservative media by the dodgy claims being made by the long-discredited analysis of Wallison and Pinto. Of course, the exact opposite of all of these claims is true.

Especially in an increasingly stratified media environment where one can easily only get information from sources that share one’s ideological convictions, political events seem to have very little impact on public sentiment. The simplistic analysis that assumes that people will, for instance, be upset at deregulated, out-of-control financiers because of the economic havoc they caused forgets that conservatives will never be exposed to the true story of what happened. This is probably not a distinctly conservative phenomenon either: many on the left subject themselves to similar levels of media insularity.

Thus, the power of the political event to galvanize change or swing public opinion seems vastly overstated. If something as massive as the housing bubble cannot majorly swing public opinion, I have little hope that other political events can do so either.