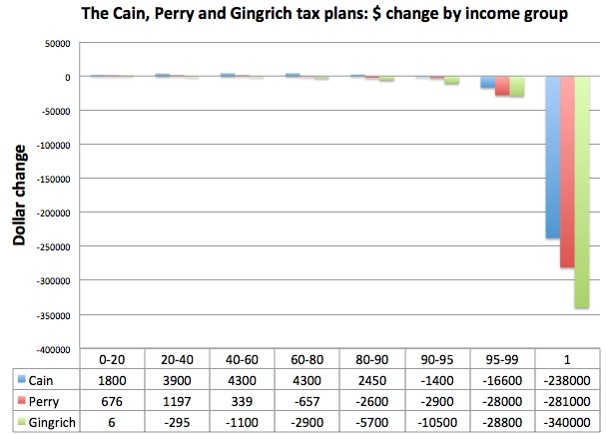

Rick Perry, Newt Gingrich, and Herman Cain have all put out a flat tax plan of one sort or another. If you want to see what this will mean for you, here are the savings you can expect organized by economic quintile:

As you can see, if you are not rich, don’t expect much. But if you are rich, you will be rolling in it. Now usually I would just note that Americans already pay flat taxes if you take into consideration all taxes, not just income tax. That means introducing a flat income tax would just make the overall tax system regressive.

But what I want to get at in this post is the strangeness of flat taxes in general. When someone advocates for flat taxes, their arguments invariably rely on the idea that everyone should be paying the same rate, that we should not be punishing people who make more, and that it is unfair to do otherwise.

But these moral kinds of arguments for flat taxes are completely confused. If you wanted to make sure that we are not punishing those with high incomes by making them pay more, the flat tax does not achieve that. The flat tax does make rich people pay more. A rich person who made $1 million will pay $100,000 in taxes under a 10% flat tax, while someone making $10,000 will only pay $1,000. The rich person is being made to pay $99,000 more! Surely if you were interested in making sure people did not have to shoulder a higher tax burden due to income, you would favor taxing a specific amount of money, not a percentage of income.

But flat tax advocates ultimately balk at this idea. If you offered an alternative tax plan where everyone paid $10,000 in taxes no matter how much income they made, almost no flat tax supporter would support you. But why? I suspect it is because flat tax advocates already buy into the idea that $1 to a poor person is not the same as $1 to a rich person. In economic terms, income has diminishing marginal utility. The richer you are, the less losing a dollar will hurt you.

But the response to this observation is not to impose a flat tax. That does not equalize burdens. Just like $1 to a poor person is not the same as $1 to a rich person, 15% of income to a poor person is not the same as 15% of income to a rich person. Broadly speaking, losing 15% of your income while making $10,000 per year will impose a much greater burden than losing 15% of your income while making $1 million per year. So, under the theory that we want everyone to shoulder an equal tax burden, a progressive tax system where the rich are taxed more is the only one that makes sense.

Thus the flat tax advocate is in a weird position. If he thinks rich people should not have to pay higher taxes, then he should favor taxing a flat amount, not a flat percentage. But he doesn’t favor that. If he thinks everyone should shoulder the same personal burden for taxes, then he should favor a progressive tax. But he doesn’t favor that either. So instead, the flat tax advocate winds up in this weird no-man’s land where no moral justification for his preferred taxing system really exists.