For some reason, Social Security seems to get more spurious claims targeted at it than almost any other government program. Commentators mislead the public by calling it a Ponzi scheme, claiming it is insolvent, and strangely calling its treasury bond holdings worthless IOUs. These claims and many others made by the Social Security naysayers are transparently stupid. But, the naysayers raise another claim that is less obviously flawed: the decreasing worker-to-retiree ratio signals a huge future problem.

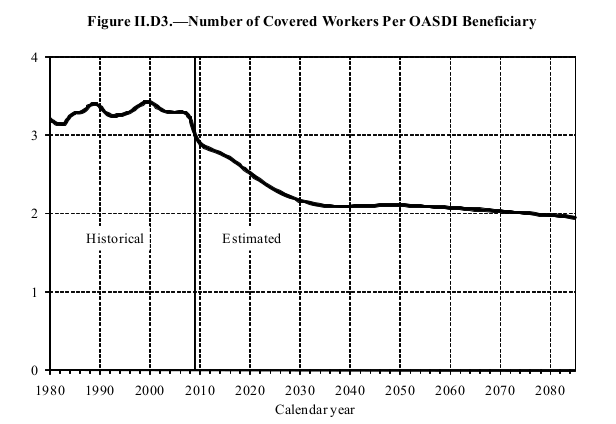

For the last thirty years, the number of workers paying into the system for every retiree collecting benefits has held stable between 3.2 to 3.4 (pdf). But, this ratio is projected to decline to around 2 workers per retiree in the next 70 years.

I admit that intuitively this could seem like a problem. Less people working for each person not working seems like an obvious issue. Despite its intuitive appeal, this understanding of the significance of the worker-to-retiree ratio is mistaken.

The only way a declining worker-to-retiree ratio would necessarily pose a problem is if Social Security was funded by taxing a set dollar amount from each worker. For instance, if Social Security taxed each worker $6,000 per year, then obviously a declining number of workers poses a problem. Going from 3 workers per retiree to 2 workers per retiree would mean a loss of $6,000 per retiree a year.

But that’s not how we collect Social Security taxes. Right now Social Security basically collects 12.4% of every dollar earned below $106,800 (the payroll tax cap). A declining worker-to-retiree ratio is only a problem if that decline is not offset by increased wages. If we go from a 3:1 ratio to a 2:1 ratio, but in the same period see wages increase 50%, then there would be no decrease in funding at all.

To see a 50% increase in real wages in the next 70 years, we would only need to see real wages grow by 0.58% per year. Given the last few decades of stagnant wage growth for everyone but the top 10% of Americans, this might be a problem. But it is a different kind of problem that has nothing to do with worker-to-retiree ratios and has everything to do with the distribution of income in society. Given that the benefits of growth are disproportionately being distributed to those above the payroll tax cap, the obvious solution is simply to remove the cap. According to the CBO, doing so would end any future Social Security deficits by itself even with the declining worker-to-retiree ratio.