Along with taxes, discussions around the deficit are made far more confusing than they really need to be. If we want to fix the long-term deficit, there are of course hundreds of different solutions. Despite having the best solutions on the deficit, those on the left are constantly depicted as totally delusional and non-responsive to the very real deficit concerns.

This is false, but the media needs some sort of narrative to keep the sides distinguished, and has consistently shied away from the class narrative that makes more sense. In any case, here is a short run-down of the left-leaning response to deficit concerns.

Social Security

Those on the right like to lump Social Security, Medicare, and Medicaid together and talk about dozens of trillions of unfunded liabilities. However, lumping the three together makes absolutely no sense when talking about the deficit because they have drastically different budgetary effects.

Social Security for instance is really fine. As I have written before (and again here), Social Security has never contributed a single penny to the debt and will not do so for another 27 years. At that point, Social Security recipients would have to take a one-time 19% benefit cut for the program to remain solvent into the infinite horizon.

Since we should avoid making that cut, small modifications need to be made in the meantime. There are tons of modifications that will do the trick. Perhaps the most popular one for those who lean to the left is to simply uncap the payroll tax. Right now, all income made over $106,800 is exempt from payroll taxes. Removing that cap would solve the long-term Social Security deficit tomorrow.

Medicare and Medicaid

While it can sometimes be misleading to group programs together, Medicare and Medicaid are best dealt in tandem because the deficit problems for each are the same: health care costs are rising at totally unsustainable rates.

I wrote a longer article all about this a short while ago, but the short of it is that the only way to fix these problems is to constrain health care costs. Since 1975, health care inflation has been more than 4%. These costs are felt across the board, both for government insurance programs and for private programs. If that is not fixed, it really does not matter what you do: things are going to be really bad.

How do we fix this? The answer again is pretty clear: adopt a single-payer healthcare system that constrains costs just like other universalized healthcare systems across the world already do. The United States spends twice as much per person on healthcare as other wealthy countries do, but does not experience any better outcomes. Fixing this totally dysfunctional healthcare system is the only way to control costs and ensure that the long-term deficits of these programs do not spiral out of control.

As Dean Baker pointed out today, if we could reduce healthcare costs in the United States as successfully as other countries have already done, that by itself would lead to budget surpluses into the infinite horizon. Implementing a universal healthcare system that controls costs — as other countries have already managed to do — is clearly the best way to keep the Medicare and Medicaid deficit in check, but it is also one of the most politically unlikely things to occur. That’s American politics for you.

Discretionary Budget

Everything that is not Social Security, Medicare, and Medicaid makes up the discretionary budget. The discretionary budget pays for all sorts of things including military, food stamps, government payroll, and so on. Fixing any discretionary budget deficits is also quite easy. As the slogan goes: end the wars, tax the rich! Well, and also get out of this recession.

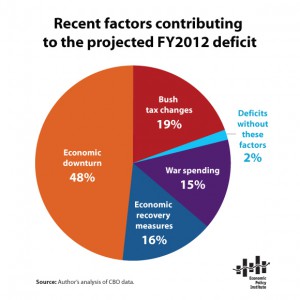

The above chart from the Economic Policy Institute details some of the contributions to the current discretionary deficit problems. There are four categories: tax cuts for the rich, the wars, lost revenues, and extra spending caused by the recession. Letting the Bush-Obama tax cuts expire (tax the rich!) and ending the wars (end the wars!) would make a big dent in the discretionary budget deficit problem. But, of course, the biggest problem is that the depressed economy has destroyed revenues while also triggering government spending on social safety net programs. Once we get the economy back on track, growth and employment will resume, increasing revenue and decreasing spending. With that, we will be able to eliminate all but 2% of the discretionary budget deficit.

Conclusion

So that’s basically it. There is a plan right there that if successfully implemented would do the trick. Uncap the payroll tax cap (or make any other dozens of minor modifications to shore up Social Security); get healthcare costs under control through a single-payer system; and let the Bush tax cuts expire, end the wars, and get the economy back on track. That is not a hard to understand plan, and there simply is not a better one out there.

So, despite the present political narrative, those on the left don’t just have their heads in the sand to the reality of the fiscal situation. If anything it is the right-wing that — despite all their constant harping on the deficit — has no plan. As David Frum put it in a recent article: “Rather than workable solutions, my party [the Republican Party] is offering low taxes for the currently rich and high spending for the currently old, to be followed by who-knows-what and who-the-hell-cares.” But of course, these are the guys the media touts as fiscally responsible.