I wrote previously about the myth of Social Security insolvency. Despite what most of the Republican presidential contenders have said, the program is on extremely solid ground. At the current rate, the program can pay out the present level of benefits until 2038 at which point it would need to take a 19% cut in order to remain solvent into the infinite horizon.

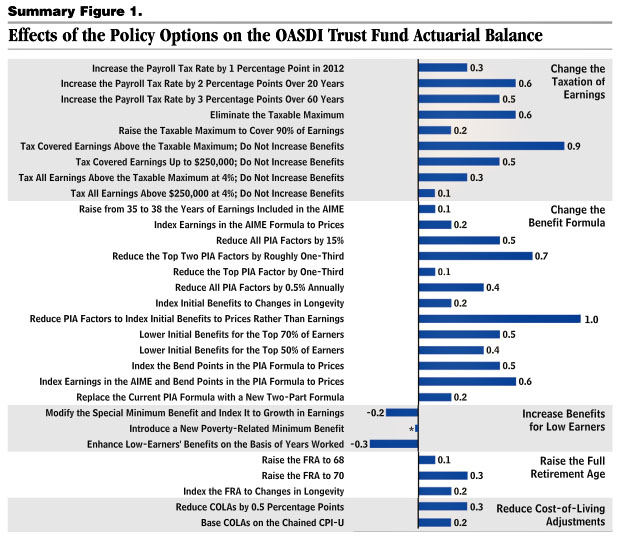

To prevent such a one-time cut, Congress could implement literally hundreds of different policy changes prior to 2038. The CBO put out the useful graphic below to highlight the options. The way the chart works is this: pick some set of policies whose numbers add up to 0.6. Once you have done that, you have solved the apparently horrible Ponzi Scheme of Social Security funding.

There are left-leaning options (raise the regressive payroll tax cap) and right-leaning options (increase the retirement age) to choose from, but the point is that finding a solution is not difficult.

Although the manufactured hysteria of pending Social Security problems is transparently absurd, what is more absurd is the proposed solutions. Both Newt Gingrich and Herman Cain have come out in favor of what they call personal retirement accounts. For those who were paying attention during the last presidency, this is identical to the plan that the Bush administration floated out, which proved to be very unpopular.

There are a multitude of problems with the idea, the most obvious of which is that transitioning to such a plan would be nearly impossible. Despite what some believe, Social Security is not a savings account: current benefit recipients get those benefits from current workers who pay payroll taxes. When current workers retire, they do not tap into their saved up Social Security taxes; instead, the new crop of workers are paying for their benefits. Thus the only way that current retirees receive their benefits is if current workers continue to pay taxes into the Social Security fund.

But the Republicans’ personal retirement accounts plan would divert payroll taxes from the Social Security trust fund and into private financial accounts. One quickly sees the problem: if the payroll taxes of current workers are diverted from the Social Security fund, then the current retirees have no source of funding for their benefits. Although the candidates are very eager to say that those who have paid in will not see their benefits cut, it is hard to see how there would not be cuts when the sole source of funding for those benefits is being diverted elsewhere.

The only way to fund current benefits while redirecting the source of funding for those benefits elsewhere would be to undergo massive deficits. So the Republicans would basically have a choice between cutting benefits out from underneath retirees or borrowing enormous sums of money to allow for a transition. I suspect that they actually intend to do the latter since it is clear that their deficit concerns are purely rhetorical. Although these candidates cannot say that they intend to unnecessarily borrow trillions of dollars to “fix” a program that is not broken, that is exactly what this type of Social Security reform would require.

As a final side note, it might be useful to understand why the Republicans would be proposing such absurd and unnecessary Social Security plans. A quick look at how the personal retirement accounts work should make it clear. Basically, instead of paying into the Social Security trust fund, workers would direct their money to investment accounts controlled by Wall Street banks. This would put a lot more money in the control of those banks and allow them to cash in enormously on fees. In essence, such a plan is a giveaway to financial institutions who would have an enormous new market in which to sell their financial products.

All of this of course has been obscured by the incompetent media, but this is basically what is going down. Republicans want to borrow trillions in order to “fix” an entitlement program that is not broken so that bankers have access to a new stream of investment revenue. You cannot make up a policy idea more sinister than this one.