A value-added tax (VAT) is a consumption tax. It is not meaningfully different from a sales tax except in the way that it is collected.

Donald Trump is reportedly considering a value-added tax as part of his tax plan. It seems unlikely that such a tax would pass into law given the current Congress. But it’s not a bad idea. In fact, it’s a good idea, which is the opposite of bad.

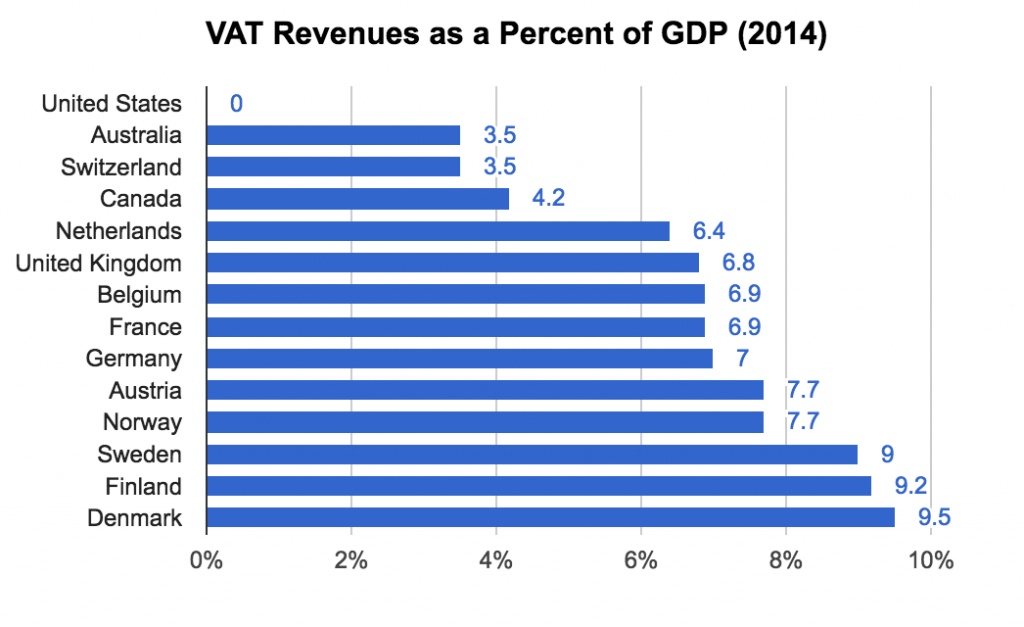

VATs are common throughout the rich, developed world. Here is how some selected countries break down on their VAT reliance in 2015:

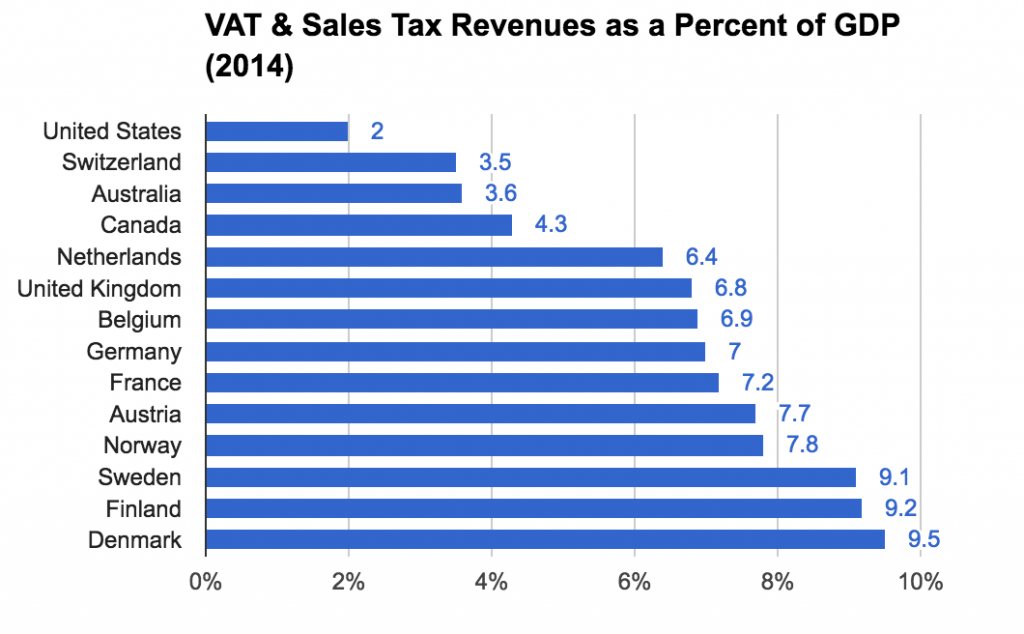

The US does not have a VAT, but it does have state and local sales taxes. If we bring those in to the picture (and include sales taxes also imposed by the other countries), the picture looks like this:

No matter how you slice it, it is clear that the US has a lot of room to introduce something like a VAT on the national level. If used to raise revenue to fund good stuff, it would be a helpful complement to the taxes already in place.

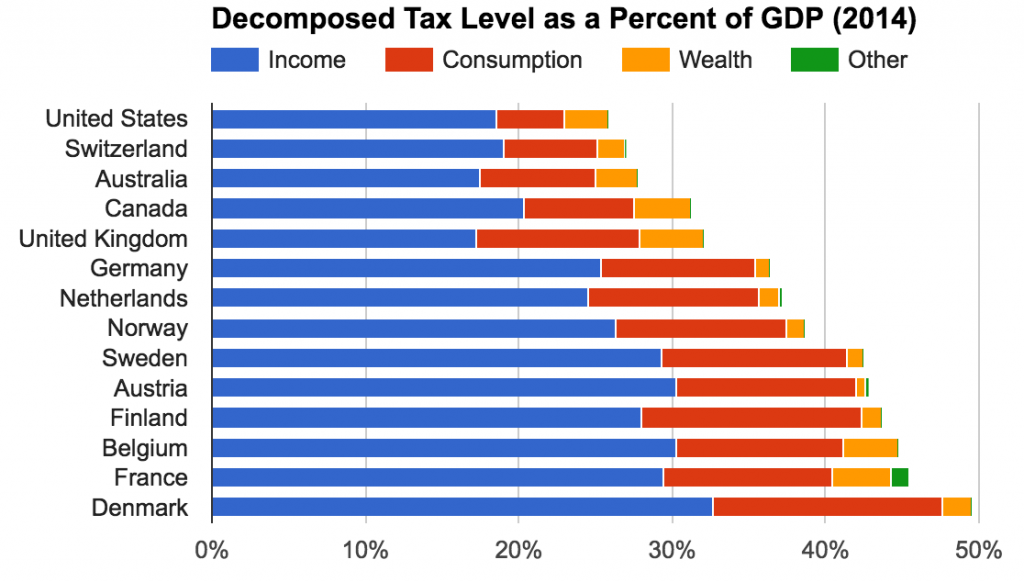

Of course, the US lags many of these countries on just about every tax that you can think of. Thus, the US could expand its tax level through other mechanisms as well, including a large increase in income taxes.