The last few months has been an banner one for the incoherent but totally hegemonic concept of “taxpayer money.” I’ve been meaning to talk about this funny concept for some time now and so I figure I should take advantage of these events to do that here.

Bobby Jindal

In Louisiana, Bobby Jindal wanted to increase revenue without raising taxes. This is because the state desperately needs more revenue, but Jindal’s political commitments make it impossible for him to raise taxes.

So here is how Jindal sensibly handled this conundrum:

- Charge public college students a new fee. ($350 million of nontax revenue).

- Provide public college students a new tax credit. ($350 million tax reduction).

- Increase taxes elsewhere. ($350 million tax increase).

So you see (2) and (3) offset each other, meaning that there is no net increase in taxes. Thus, under normal revenue accounting, Jindal raises $350 million solely with nontax revenue, i.e. the fee in (1). The new revenue increase is, I guess, not “taxpayer money.”

The consensus liberal take seems to be that this is a ridiculous gimmick, as if there is deep down some sort of obvious taxing going on here. But these objections operate of the assumption that taxation is a clear concept when it very much isn’t. Jindal’s move is not obscuring a tax; rather, it is taking advantage of the fact that “tax” is not a coherent thing and is interchangeable with almost any other distributive move.

For example, suppose the US government wanted to balance a revenue shortfall by reducing the disposable income of old-age pensioners. It could do so by cutting Social Security benefits, which is scored as a spending reduction that has nothing to do with taxes. Or it could do so by increasing taxes on Social Security benefits, which would be a tax increase. These are distributively identical actions, but one is a tax and the other isn’t. If you think Jindal’s student fee scheme is really deep down a tax, then mustn’t you also think Social Security benefit cuts are deep down a tax? Wouldn’t such a cut be an assault on “taxpayers”?

Jordan Weissman

If you think I am nitpicking here, consider another recent and interesting use of “taxpayer,” this time from Slate’s Jordan Weissman:

Lee Siegel is an award-winning critic and an unrepentant leech. After pursuing not one, not two, but three degrees from an Ivy League university, he chose to default on his student loans at taxpayer expense, because he felt that paying them back would have hampered his ambitions of becoming a writer.

Yesterday Weissman did it again:

Earlier this month, Bloomberg turned up Laura Strong, for instance, a part-time therapist and yoga instructor who took out $245,000 for a Ph.D. in psychology, toward which she is contributing $100 dollars a month under Pay as You Earn. Two decades from now, taxpayers will likely have to eat whatever she doesn’t pay off.

What’s interesting here is that, at least in most cases, student loan defaults are fully accounted for in the interest rate charged by the Department of Education. That is, the DOE sets the interest rate on student loans at such a level that the student loan system is “self-funding” even with defaults here and there. The incidence of the cost of defaults is borne, not by the “taxpayer” in some quasi-normal sense of the word, but rather by other student debtors who pay somewhat higher interest.

Of course, all government revenue is fungible, and so in some sense the student loan interest bucket is not meaningfully distinguishable from the official tax revenue buckets, and so maybe there is some sort of “taxpayer expense” going on here. Though, if we use fungibility in this way to access the word “taxpayer” in situations like this, then that also means money spent on roads is coming at “student debtor expense,” for student debtors also contribute to government revenue.

More Generally

Aside from these two examples, what’s bugged me generally is the way in which “taxpayer money” is used totally inaccurately as a substitute for “public money.” For starters, “taxpayer money” is an obvious oxymoron because any money that is taxed is, by definition not the money of the person we call the “taxpayer.” The laws determine what money belongs to who and tax laws clearly demarcate that the money does not belong to the taxed.

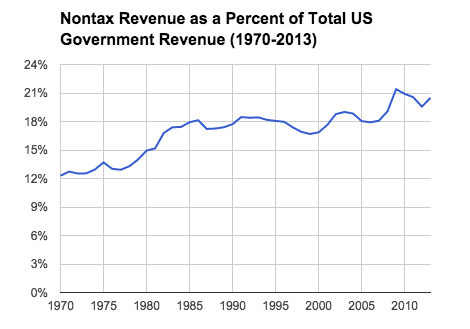

Aside from that point though, the usage is inaccurate because not all government revenue comes from taxes. A good deal of it comes from fines, licenses, fees, tolls, lotteries etc. And this is increasingly true. According to the OECD, 20% of total US government (local, state, and federal) revenue in 2013 was nontax revenue. This means 1 in 5 public dollars do not come from what gets categorized in national accounting as “taxes.”

Moreover, the share of government revenue coming from nontax sources has been on the rise:

Between 1970 and 2013, US government revenue increased from 29.7% of GDP to 33.2%. Nontax revenue growth accounts for nearly all of that revenue growth (92%). Or to put it in the confusing parlance of pundits: nontaxes account for almost all of the growth in taxpayer money. Heh.

Solutions

When talking about “taxes” versus “fees” versus “cuts,” it can become very difficult practically to avoid picking one and going with it for descriptive purposes. This is the hazard of the way we’ve decided to carve up specific distributive categories. Some halfway accurate usage is thus understandable.

What’s not understandable is why “taxpayer money” (or similar) gets so much use, despite the fact that it is an objectively inaccurate descriptor. That is to say, the phrase literally is lying about the origin or whatever of the money being talked about, 1/5th of which is from nontax sources. “Taxpayer money” serves certain ideological ends well, which explains some of its usage, but it serves truthful description purposes extremely poorly. Meanwhile “public money” is a 100% accurate description.