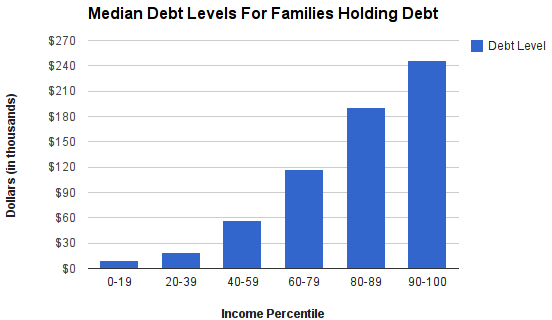

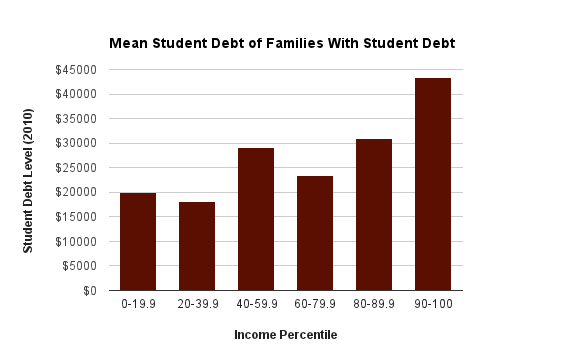

I’ve kept tabs on the whole Strike Debt thing since its beginning. Those that read David Graeber and subsequently decided debt is the big thing are an interesting lot. In reality, debt is positively associated with income: the richer you are, the more debt you have.

Needless to say, a focus on debt is pretty incoherent. The only way you make it less incoherent is to talk about income inequality and how that affects what debt means to a given class. But doing that shows you aren’t mad about debt; rather, you are mad about distributive inequality and are simply expressing that anger through the horribly clumsy proxy of debt. But whatever. Strike Debt is not a club of policy wonks and so you expect some incoherence, especially around messaging, and you leave it be.

But now Strike Debt has this long piece about Pay It Forward in Jacobin, and it’s pretty bad. I flirted with a line-by-line drive by, but that would be too long. So let’s just hit some highlights.

As a preliminary matter, you should know that Pay It Forward is basically a college attendee tax. Instead of paying tuition, you pay an income tax to fund tuition subsidies. It is identical to every other leftist call for free higher education except it excludes people who don’t attend from the tax, which incidentally makes it more distributively fair because rich people disproportionately attend college. Excepting the relatively poor set of people that don’t attend college from paying the free tuition tax infuriates Strike Debt, oddly enough.

Pay It Forward Would Use Bonds, The Horror

The first objection is an incompetent play off of what people have called the “gap problem.” You see, if you are going to have a college attendee tax, that means that first you have to pay for people to go to college and then tax. And that is supposed to be some unique problem to Pay It Forward. But actually it’s a non-unique problem that applies to all plans that use public tuition subsidies.

Suppose I want to use a general tax (instead of a PIF tax that excludes non-attendees) in order to fully subsidize tuition. What do I do? Well it seems like there is no gap problem here, right? You just tax right away. But not so fast. There is a gap problem. People who already went to college under the prior policy regime already paid their share into the higher education system. That is, after all, the whole point of this student debt thing isn’t it? That recent graduates have already paid a ton into the higher education system, hence their debts? Imposing a general tax on them means charging them twice for higher education funding, once when they first paid (leading to their crushing debts) and then again through this tax!

The only way to avoid this double-payment problem — under a general tax regime or a PIF regime — is to issue bonds in the short term in order to spare the already-graduated from contributing. Of course, you can just say screw it, and tax the already-graduated and cause them to effectively double-pay into the higher education system if you’d like. But again, that’s true of both PIF and general taxes. If you want, you can just start taxing college graduates right now, and kill the gap problem.

Like basically 99% of the anti-PIF arguments, this is totally non-unique. The argument has nothing to do with PIF and everything to do with the troubles of using tax-funded public subsidies right now at this moment, whether those subsidies are funded through PIF or general taxes. Sadly few understand that because general taxes and PIF are almost entirely identical, you will never get argumentative traction against PIF unless you focus on the tax exemption part of it. This argument does not do that, and accordingly it fails.

Cuts In State Funding

This section of the piece is literally devoid of content. Here is a quote:

If widely adopted as a model, PIF might well be used to absolve legislators in other states of any responsibility for public support of colleges. Income-based repayment plans could supplant existing programs that encourage wider access to education, replacing them with a one-size-fits-all model that could end up hindering access for underserved communities.

Replace PIF here with “general taxes” and check it out: the block quote still works. Perhaps if we just make tuition free at the point of delivery with general taxes, state legislators will become uninterested in targeted programs. Right? Maybe. I don’t know. But more importantly, this has nothing to do with PIF, and everything to do with tax-funded full tuition subsidies. It is almost as if general taxes and PIF are basically entirely the same except they have different tax bases, and therefore non-tax-base arguments you throw against PIF will be non-unique. If only someone had pointed that out before, we could have saved ourselves so much analytic embarrassment!

Adverse Selection

On this objection, all of the future high-earners (who somehow know about their future earnings at 18 years of age) will flee the public schools. Of course, if you want to make sure nobody flees to avoid PIF taxes, you make it universal. But even if you can’t make it universal, it is not the case that it makes sense, on risk-adjusted terms, to flee a PIF-funded school on the theory that you will save money in the long run. If you are going to argue it does, you better be doing discounted cash flow analysis, which is noticeably absent from the Strike Debt piece. Here is one such analysis I ventured a short while ago, though it is just a very cursory look intended to introduce the concept.

Redistribute Money to the Rich

Here is where their debt politics pop in and they say we should increase social inequality: “A restructuring of education funding must include erasing the $1.2 trillion in illegitimate student debts that are already on the books.”

It turns out that, like debt in general, the rich have more student debt. A flat forgiveness would be a deep class war injustice.

The Howler

To cut this long post short, I will just leave you with the most hilarious thing in the piece.

Furthermore, we disagree with the suggestion, made by the Working Families Party, that PIF is comparable to social security. Being run by the state does not in itself make a program a public good. It’s more instructive to compare PIF to the Affordable Care Act, which expands the private healthcare market and guarantees profits to health insurance companies while doing little to address individualized debt burdens.

What on earth? I mean seriously, what on earth? This analogy is insane. Obamacare uses tax subsidies to pay private insurance companies that then pay private hospitals. PIF uses tax subsidies to pay public schools. Again, it is identical to the the general tax model, except it exempts non-attendees from the general tax. That is it! How exempting non-attendees from tax turns tax-funded public tuition subsidies into something akin to subsidizing private insurers who then pay private service providers is beyond me.