There is a story out there that young people are facing escalating levels of debt. The student debt crowd is specifically fond of this story. But it isn’t so.

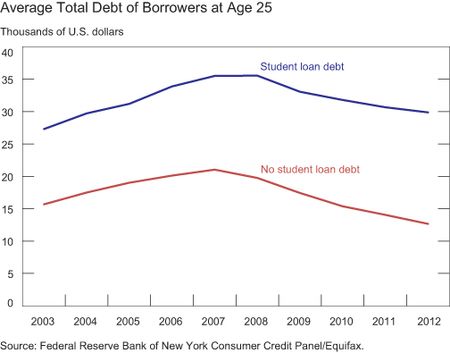

The above graph comes from a recent Fed report that primarily set off a swarm of discussion about mortgages and car loans. More interesting to me is that 25-year-old borrowers have seen their total debt levels decline since 2008. This is true of those with student debt and those without it.

Could this be because the total number of young borrowers is expanding, which is dragging the average of borrowers’ debt down, even as youth debt in total is rising? It doesn’t look like it. A recent Pew Study, which was profiled in the Wall Street Journal, found that 22% of young Americans have no debt, which is the highest percentage since 1983. The same study found that the debt level of a typical young household (young meaning below 35 years old) has $15,000 of debt, which is the lowest debt levels for such households since 1995.

As with everyone else, young people — student debtors included — are reducing their overall debt levels. My takeaway is that we should be skeptical of most of the student debt alarmism, as has been my take from the beginning. There may be good reasons to cut student debt, but the debt crisis theory is less than compelling up against the best evidence we currently have.

h/t Derek Thompson