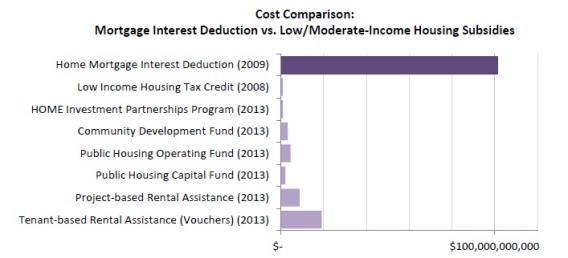

Matt Yglesias has a nice chart today comparing the cost of the mortgage interest tax deduction to the cost of other kinds of housing subsidies:

It turns out that the mortgage interest deduction absolutely dwarfs the housing subsidies provided primarily for low-income renters. The mortgage interest tax deduction skews to the wealthy for a few reasons. First, poor people generally rent, not own. Second, wealthier people generally have more expensive homes and therefore bigger mortgages and therefore higher mortgage interest payments. Finally, tax deductions reduce an individual’s adjusted gross income for tax purposes. This means those with incomes in higher tax brackets reduce their tax burden by more than those in lower tax brackets even if the amount of their mortgage interest deduction is identical.

It really is a scandal that we have things set up this way. If someone proposed a bill to start a Mortgage Welfare Agency that is charged with the duty of sending checks to those paying off mortgages each year, it would never pass. But somehow, the mortgage interest tax deduction — which is economically identical to the hypothetical Mortgage Welfare Agency — is allowed to exist. The mortgage interest tax deduction redistributes after-tax income upwards, redistributes tax burdens downward, and deprives the government of an enormous amount of revenue that could be used for cash transfers to the poor or direct social provision.