I have been desperately trying to find data on the effect state and local taxes have on the progressivity of taxes in the United States. I wrote a post a few days ago talking about how to think about the tax system, but I only included data on federal taxes. When only counting federal taxes, Americans pay slightly progressive taxes (this graph includes government transfers):

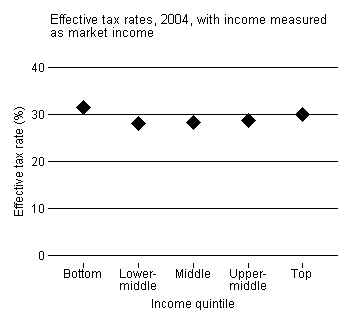

However, Lane Kenworthy actually provides this data with state and local taxes included. According to Kenworthy’s breakdown of Tax Foundation data on state and local taxes, when you factor in all tax burdens (not including government transfers), you get this quintile tax distribution (note these two graphs are breaking down taxes from different years):

That’s right, when you take into consideration all taxes — federal income taxes, payroll taxes, excise taxes, corporate taxes, state and local taxes, and so on — you find that Americans actually pay nearly flat taxes of around 30%, with the poor paying slightly more than that.

This is a huge deal. Almost all of right-wing tax rhetoric is based upon the idea that rich people are being basically looted while lower income people pay nothing at all. But this data indicates that on average, this is simply not true. Rich people pay more of some taxes (e.g. income and corporate taxes) while poor people pay more of other taxes (e.g. payroll taxes and state and local taxes). But when you aggregate all of those tax payments together and divide by income, you actually get a nearly flat tax rate across each economic quintile.

Those on the left should be making way more of this data than they are.