I’ve been going on and on and on about socializing finance ever since Seth Ackerman’s pulled the idea out of relative obscurity by writing a piece about it in Jacobin. Without going into the particulars of how it is done, the basic idea is to have the government buy up some (or perhaps all) financial wealth, e.g. shares in publicly-traded companies. This would literally “socialize” finance because the owners of rent-gathering financial wealth would be the public, not private individuals.

After he wrote his piece, Ackerman clarified that his main interest in socializing finance had to do with making it easier to pass certain kinds of policies like basic guaranteed incomes. Because such policies go against the interests of capital, transferring ownership of capital (i.e. financial wealth) to the public would reduce the power of owners to block such policies. Presumably he has in mind a kind of Claus Offe capital strike analysis, which basically observes that private capital has the ability to check the power of government by divesting its capital, something that would not happen were the capital itself publicly held.

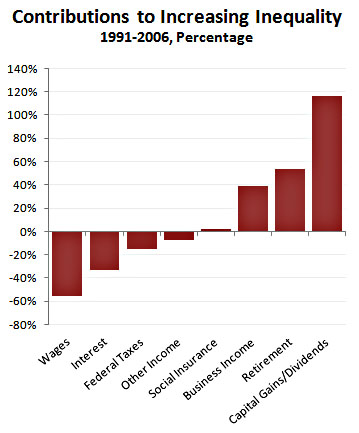

Socializing finance has other appeals as well, some of which I think are more important than greasing the wheels of decommodification. In particular, socializing finance helps capture the passive, unearned incomes of the investing class and redirect those incomes to the public at large. A recent study by Thomas L. Hungerford on what’s driving rising inequality highlights why capturing investment income is so important. According to the study (which Kevin Drum has coverage of), capital gains and dividends have contributed more to the increase in after-tax income inequality than all other factors combined:

The share of total income coming from capital gains and dividends has increased over the past 20 years, and this has had dramatic disequalizing effects. By socializing ownership of financial wealth, we could capture these gains and pay them out to everyone as a kind of social dividend. The Alaska Permanent Fund provides a fantastic example of how this might work. This kind of program would improve inequality in two ways: first by intercepting incomes largely flowing to the already-rich and then by paying out that intercepted income to everyone.

Now some will say that this is not necessary. We can just tax capital gains directly. The liberal line is that capital gains taxes have no effect on total growth. I’ve never been totally convinced by this. Sure you can cite periods where capital gains taxes are high and growth is high and then cite periods where capital gains taxes are low and growth is low. But none of that tells you how much growth or investment there would have been in the alternative. Just because growth was high during a period of high capital gains taxes, that does not mean it would not have been even higher without them. As we only have one sample of history, this kind of question is hard to definitively answer.

To the extent that we are concerned that capital gains taxes will cause short-term and long-term drags on the economy, socializing finance solves that through direct ownership. Instead of capturing some small fraction of the financial rents owners collect, we capture all of the rents on the publicly owned wealth, and do not do so in a way that affects the incentives of anyone else to invest. So socializing finance gets all of the benefits of a capital gains tax while avoiding all of the usually-cited problems.

Public ownership of financial wealth is one of those policies that just really stands out as hitting all of the points leftists complain about with respect to finance capital. Such ownership wrestles away unearned income flowing to wealthy people purely from ownership (regarded by Marx as exploitative theft). The captured income can then be used to create a more egalitarian income distribution in society (flattering those like myself who think distribution is key). Then finally, shifting ownership itself undercuts some of the power of private capital to fight against public programs that might help along a project of decommodifying society (which appeals to a very prominent set in the leftist milieu).