The Wall Street Journal has an article today about the rising student debt burdens of the well-off. In the article, the WSJ details findings from the newest Federal Reserve Survey of Consumer Finances. Among households in the 80th-95th income percentile — the WSJ’s definition of “upper-middle-income households” — 25.6 percent had student loan debt in 2010, a more than 6 point increase from 2007. Notably, this percentage is higher than the overall percentage of households with student debt, which in 2010 stood at 19.1 percent.

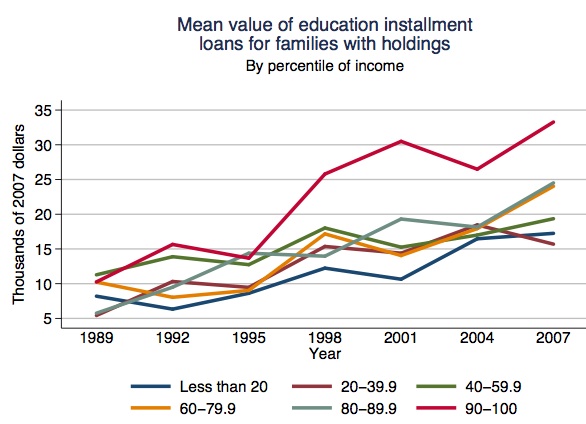

Student debt levels among these households also increased. The average student debt for households in the 80th-95th income percentile is up to $32,869, an increase of more than $6,000 from 2007. For readers of this blog, the point that student debt is disproportionately shouldered by the well-off should be a familiar one (I, II). Starting in 1995, the average student debt holdings of the richest 10 percent soared above the rest, with the average holdings of the next richest 30 percent of households immediately below them.

Despite popular rhetoric to the contrary, this is hardly a counter-intuitive result. The most lucrative degrees — professional and medical degrees — are also the most expensive. So naturally, those with the highest incomes are also likely to have the highest debt totals. Additionally, kids from high-income backgrounds are generally more qualified for college than those from poorer backgrounds, meaning they are more likely to go to college and more likely to go to better, more expensive, colleges.

This new data raises the question once again: what exactly should we be trying to do with higher education financing? In his tweet about this article, the venerable Doug Henwood rhetorically asked “A new constituency for free tuition?” Although the answer to this question may indeed be yes, is that actually a good thing from a class perspective? The whole point of the WSJ article is that student debt disproportionately afflicts the well-off. Consequently, free tuition would disproportionately benefit the well-off, presumably increasing overall inequality.

There is some strange mental disconnect that goes on with the left and student issues. To see an article that details the extent to which student debt burdens the rich and take away that we need to eliminate it is a bit odd to say the least. Of course, Henwood and others like him are not advocating free tuition because it will primarily help the well-off: that is just a byproduct. With that said, I am genuinely unclear on what the left point on free tuition is exactly. When I press the point, I am usually met with exasperated hand-waiving, which is unfortunately not followed by anything coherent.

Is there some jargon-heavy points about “neoliberal user fees” and “commodification” that we are supposed to be up in arms about? Generally, the left position on student debt seems to proceed by wrongly assuming debt primarily burdens poor people. Once you correct that empirical mistake, it is really not clear to me what is left. That is not to say there are no better alternatives to the current way of financing higher education: there clearly are. Free tuition funded by general revenues is the worst such alternative however, at least from an egalitarian perspective.