As a follow up to my EITC post yesterday, I want to emphasize that one problem with the EITC is actually present in every single child tax benefit we have. In one form or another, all child tax benefits we have are earnings-related, meaning the lower your earnings, the less you get. This design, which weirdly has bipartisan support, is where our deep child poverty comes from.

By now most people who follow tax policy know that many of our tax programs are designed in horrible ways that unfairly distribute benefits to richer people rather than to poorer people. Normally, people who make this point focus on things like the mortgage interest tax deduction or tax exclusions for individual retirement accounts and 401ks. But the critique equally applies to the country’s child tax benefits, even though those benefits receive far less negative attention.

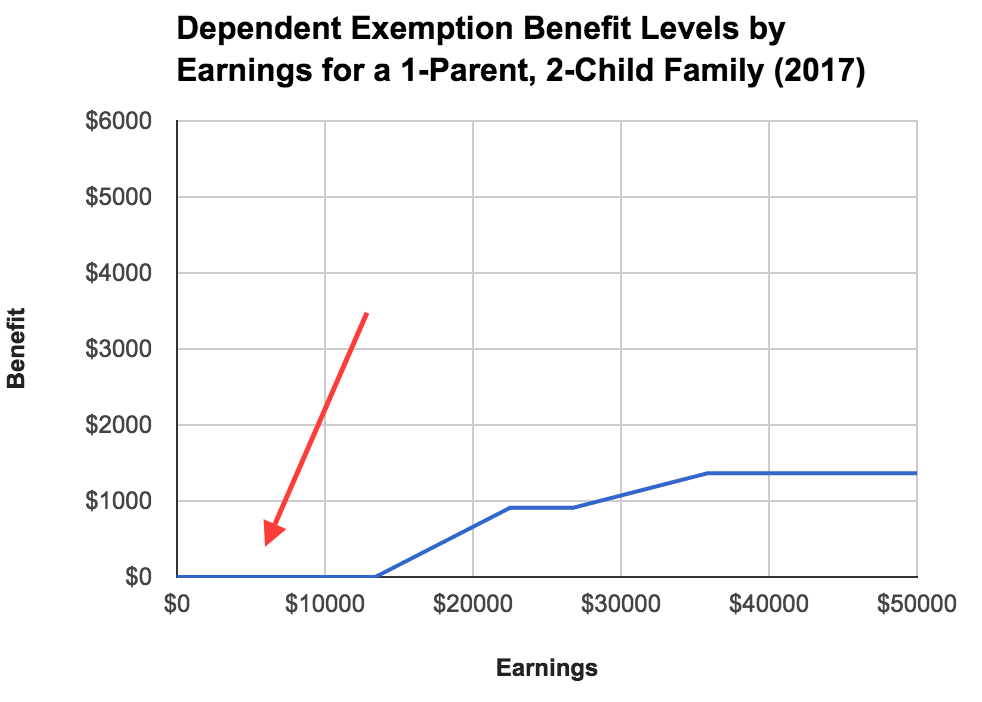

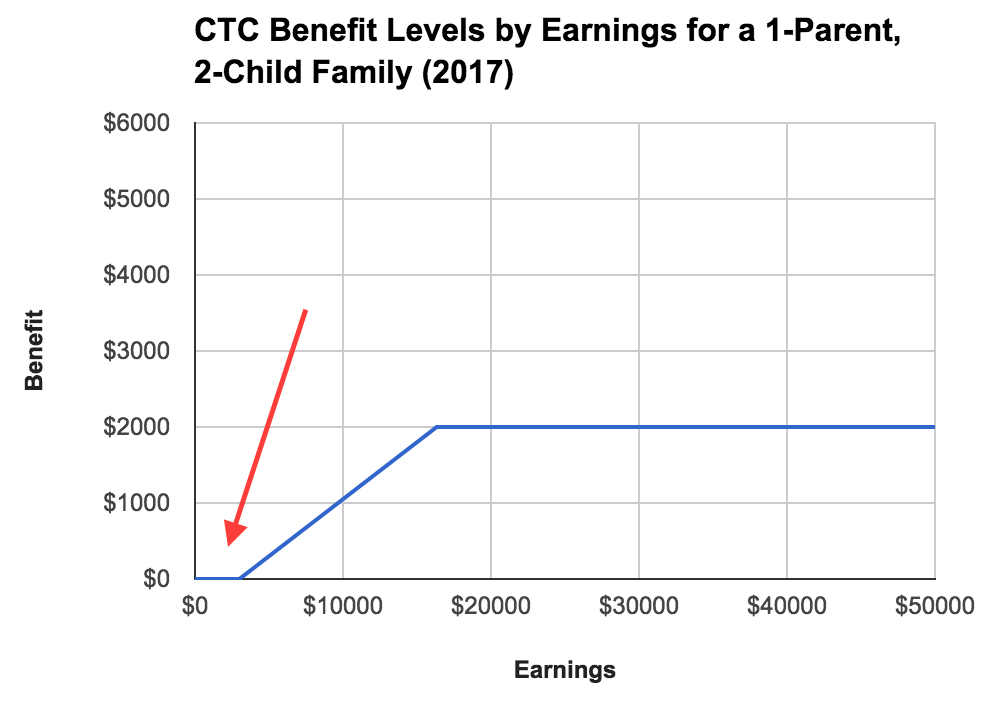

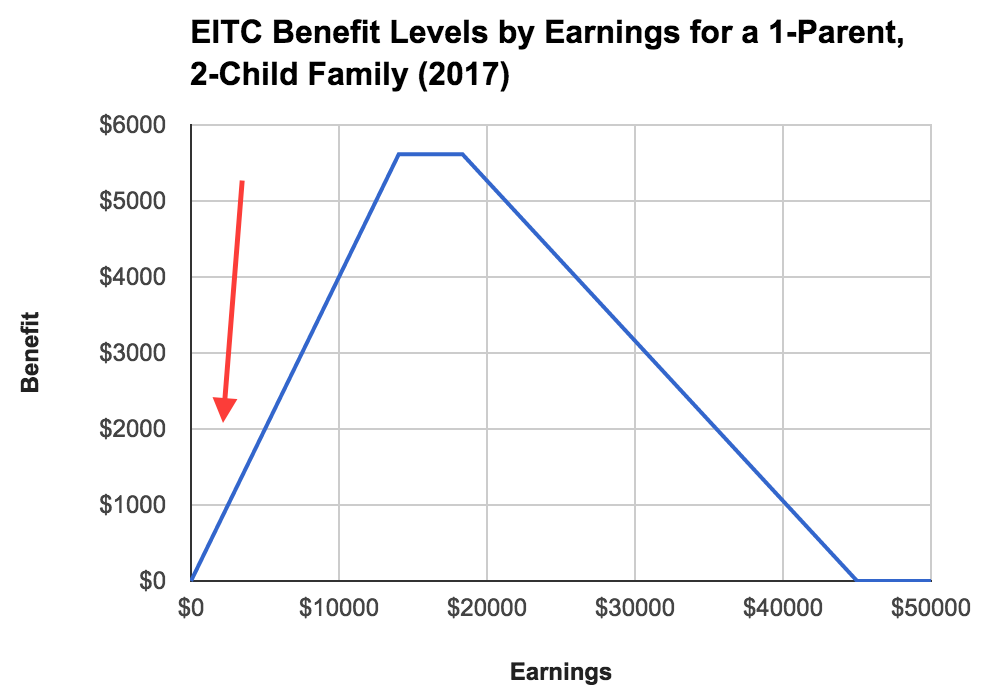

To see what I mean, consider the following graphs of three child tax benefits. The graphs are based on what benefits a 1-parent, 2-child family would receive based on their earnings. The red arrow in each graph shows you who is being excluded from the benefit.

Although I did not include them above, the head of household filing status and the child and dependent care tax credit have the exact same problem. For all five benefits, legislators decided that children with low-earning parents should starve. And they do.

As I noted in my EITC post, these designs are absurd on their face because children of low-earners have no less need for benefits than children of high-earners. Indeed, it’s the opposite. Furthermore, children have no say over what their parents’ earnings are. The fairness case for universal benefits when it comes to children is overwhelming.

Doubling down on earnings-related child benefits, as proponents of EITC expansion do and even as proponents of CTC expansion often do (see Hillary Clinton), is a terrible idea. Instead, we should scrap all of the child benefits in the tax code and pay out a universal per-child benefit to every family with children.

In the case of the EITC, this would mean eliminating the child-related components of the program and having a pure wage subsidy program that pays out the same benefits to all adults with the same earnings regardless of how many children they have. In the case of the other four child tax benefit programs mentioned above, this would mean eliminating them entirely and plowing the savings (plus other money) into the universal child benefit program.