In my last post, I said that it would be good if the US imposed a consumption tax such as the value-added tax (VAT). Critics generally say that these kinds of taxes are bad because they are “regressive.” While it is true that they are regressive under the way that word is generally used, that entire way of thinking about taxes is confused and muddled (as I’ve discussed previously in the case of the Nordics).

The standard response to those who raise the regressivity objection is to say that it just depends on how the proceeds of the consumption tax are spent. This is true, but only because it is true of all taxes. Even progressive taxes are only good if the proceeds are spent well. You could spend them on bad things and even in ways that make inequality worse.

The bigger problem with the regressivity objection, in my view, is that dividing taxes paid by income seems to obscure the more important point. What really matters in all of this is how many dollars you are scraping from poor, middle class, and rich people. Consumption taxes scrape more dollars from people who consume more and it is the rich who consume more.

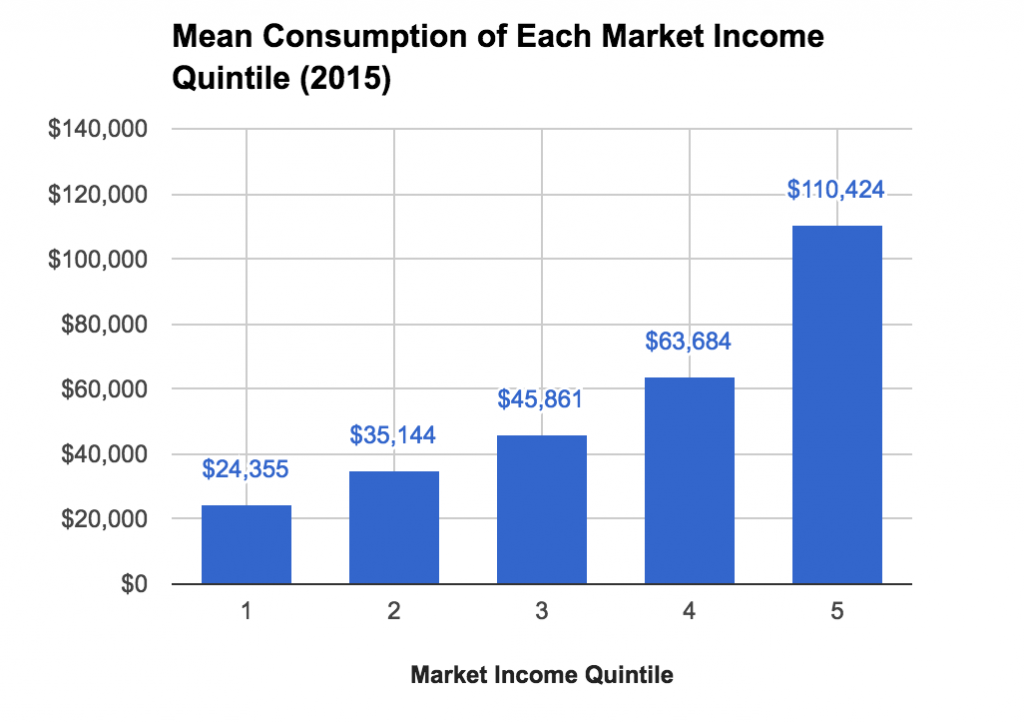

According to the 2015 Consumer Expenditure Survey, the richest income quintile consumes an average of $110,424 while the poorest income quintile consumes an average of just $24,355.

A 10 percent consumption tax would thus draw $2,435 from the poorest quintile and $11,042 from the richest quintile. Which is to say that such a tax draws 4.5 times as much money from the rich as the poor.

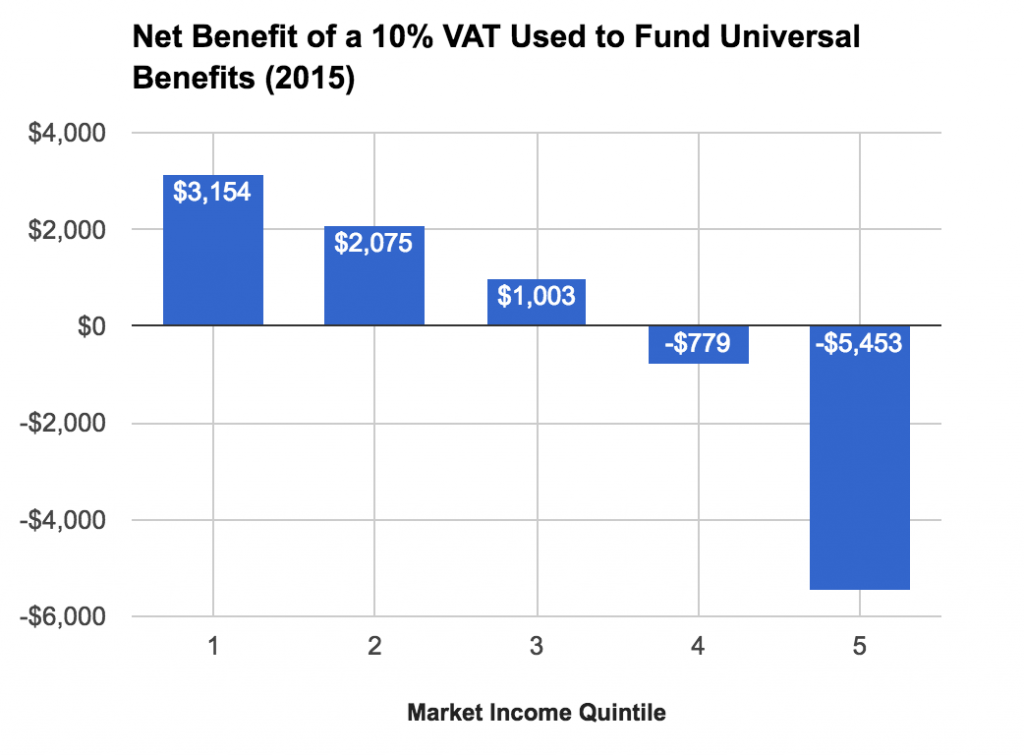

Whether the money drawn from the consumption tax ultimately reduces inequality does depend on how it is spent, but it is not like it needs to be spent in an especially “progressive” way, i.e. in a way that is heavily targeted towards the poor. Even if you spent this money in a way that benefited all quintiles equally, you’d still see a pretty significant net swing.

Of course, this graph features a rather simplistic analysis as it assumes consumption does not change at all in response to the tax and benefit reforms. But even if the precise figures would be somewhat different in a real life implementation, the basic pattern of the graph above would still hold.

None of this is to say that a consumption tax is better than other taxes. The US has plenty of room to increase its tax level by upping income taxes, and so that’s a natural place to look. But to say consumption taxes are bad generally is pretty clearly mistaken.